Did Mamaearth's Pre-IPO Inventory Push Mask Deeper Financial Troubles?

Mamaearth's aggressive inventory push before its IPO and subsequent struggles with unsold stock raise questions about its financial health and transparency, jeopardising its transition from an online brand to a retail powerhouse.

In the afterglow of its initial public offering (IPO) in November 2023, personal care startup Mamaearth's CEO Varun Alagh exuded confidence and ambition. “We can deliver market-beating growth," he told multiple publications promising a bright future for the direct-to-consumer (D2C) brand. He boldly declared, "We are ready to grow fast even at the cost of our bottom line." These statements painted a picture of a maturing company ready to take on India's competitive personal care market.

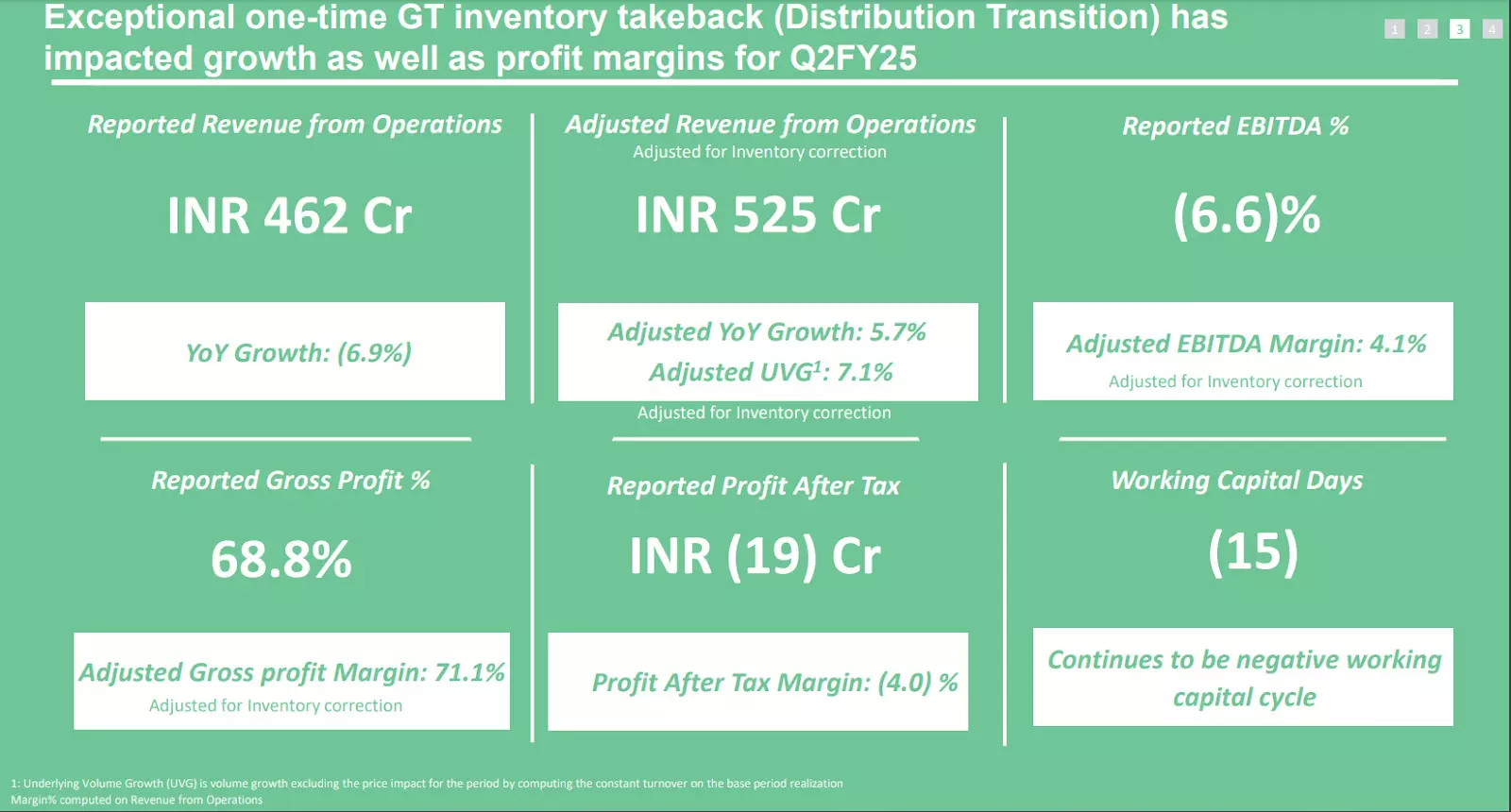

Fast forward to almost a year after the IPO, and the narrative has changed quite a bit. Despite posting record profits of Rs 40.2 crore in Q1FY25, the company reported a net loss of Rs 19 crore in Q2FY25. Its second-quarter revenue declined 17% quarter-on-quarter to Rs 461.82 crore, falling short of the Rs 500 crore benchmark. For many D2C brands in India, reaching revenue milestones like Rs 100 crore, Rs 250 crore, Rs 500 crore, and Rs 1000 crore mark significant stages in their growth journey. These benchmarks symbolise their increasing scale and competitiveness within the larger market.

In a call with analysts in November, Varun Alagh, attributed this decline in revenue to accounting provisions made for Rs 63 crore wort...

In the afterglow of its initial public offering (IPO) in November 2023, personal care startup Mamaearth's CEO Varun Alagh exuded confidence and ambition. “We can deliver market-beating growth," he told multiple publications promising a bright future for the direct-to-consumer (D2C) brand. He boldly declared, "We are ready to grow fast even at the cost of our bottom line." These statements painted a picture of a maturing company ready to take on India's competitive personal care market.

Fast forward to almost a year after the IPO, and the narrative has changed quite a bit. Despite posting record profits of Rs 40.2 crore in Q1FY25, the company reported a net loss of Rs 19 crore in Q2FY25. Its second-quarter revenue declined 17% quarter-on-quarter to Rs 461.82 crore, falling short of the Rs 500 crore benchmark. For many D2C brands in India, reaching revenue milestones like Rs 100 crore, Rs 250 crore, Rs 500 crore, and Rs 1000 crore mark significant stages in their growth journey. These benchmarks symbolise their increasing scale and competitiveness within the larger market.

In a call with analysts in November, Varun Alagh, attributed this decline in revenue to accounting provisions made for Rs 63 crore worth of inventory returns from its wholesale distributors, explaining that the company was making pivots and adjustments to its retail model. Alagh also admitted to analysts that the returns were "higher than what we had imagined."

Analysts, however, were sceptical of Alagh’s explanation particularly because he had previously downplayed the potential impact of these distribution changes in previous earnings calls.

The Origins of Mamaearth

Mamaearth's origins trace back to the Alaghs’ quest for safe baby products. In 2016, as Varun and Ghazal Alagh awaited their first child, they were dismayed by the prevalence of harsh chemicals in available options. Determined to find better alternatives, they leveraged Varun's tech expertise and Ghazal's passion for natural ingredients to create Mamaearth. Their mission: provide toxin-free, safe, and effective products for babies and adults. They started with baby care essentials like lotions, shampoos, and diaper rash creams, all formulated with plant-based ingredients and free of harmful chemicals like parabens, sulfates and mineral oils.

Varun Alagh's career includes senior brand managing roles at large consumer retail firms, including Hindustan Unilever, Diageo PLC, and Coca-Cola which was his last role before starting up Mamaearth in November 2016. Ghazal Alagh's background lies in the arts and education, working as a corporate trainer and artist, according to her LinkedIn details. She also co-founded Dietexpert in 2012, a platform focused on healthy living and nutrition.

Today, Mamaearth is a sub-brand of its parent company, Honasa Consumer Ltd, contributing a significant portion to its overall sales. Over the last eight years, Honasa acquired and began to operate other brands such as BBlunt, Dr. Sheth's, Momspresso and others.

But the company, once a symbol of India's burgeoning D2C revolution, finds itself grappling with inventory woes, disgruntled distributors, and mounting questions about its financial transparency. The company's aggressive push into offline retail, coupled with allegations of artificially inflating revenues, has cast a shadow on its once-celebrated growth story.

Mamaearth’s Distribution Bungle

While Varun Alagh’s explanation of higher-than-expected returns from distributors seems like a plausible cause, a look through its books shows more than what meets the eye. It seems that the company showed inflated revenues ahead of its IPO and a correction has now revealed the real situation of the company.

In the Q1FY25 conference call, Varun Alagh had asserted that an upcoming transition in its reliance distribution model would not significantly affect sales, margins, or working capital and that there were no inventory write-off risks in the long term.

Hence, the Q2FY25 results, where the company reported a net loss and a 17% quarter-on-quarter decline, therefore, came as a shock to analysts and investors. A particular concern of analysts and investors was the decline in Mamaearth’s parent company Honasa's overall EBITDA margin to -6.6% in Q2 from 8.3% in Q1, primarily due to the Rs 63 crore inventory returned as part of the retail model transition.

This transition involved Mamaearth shifting away from selling to wholesale "super stockists" in favour of smaller, direct distributors in major cities. The company claimed this would provide closer control over inventory and better sales data.

Super stockists are intermediaries between companies and networks of smaller distributors or retailers. They function as wholesalers, purchasing products in bulk from manufacturers like Mamaearth and then reselling them to smaller players within a specific region. This model simplifies logistics for D2C companies such as Mamaearth, as they deal with fewer, larger entities rather than managing numerous smaller accounts.

Honasa even gave a name for this pilot of shifting away from super stockists, calling it ‘Project Neev’. According to the company, the Mamearth brand had been growing slower than expected and hence it felt that moving to direct distributors could bring back the brand to a positive sales trajectory. When Honasa went public in November 2023, the Mamaearth brand accounted for around 65% of its overall sales and still continues to be the majority revenue contributor. A de-growth in revenues from Mamaearth would mean a significant challenge to the publicly traded firm, and hence the company asserted that the retail distribution overhaul was the only way to bring back growth for brand Mamaearth.

So, a closer examination of the company's profit and loss statement, specifically its inventory figures, revealed a concerning anomaly. The Rs 63 crore in returned inventory, compared to the substantial stock pushed to distributors before the IPO, raises serious questions about Honasa's revenue recognition and accounting practices.

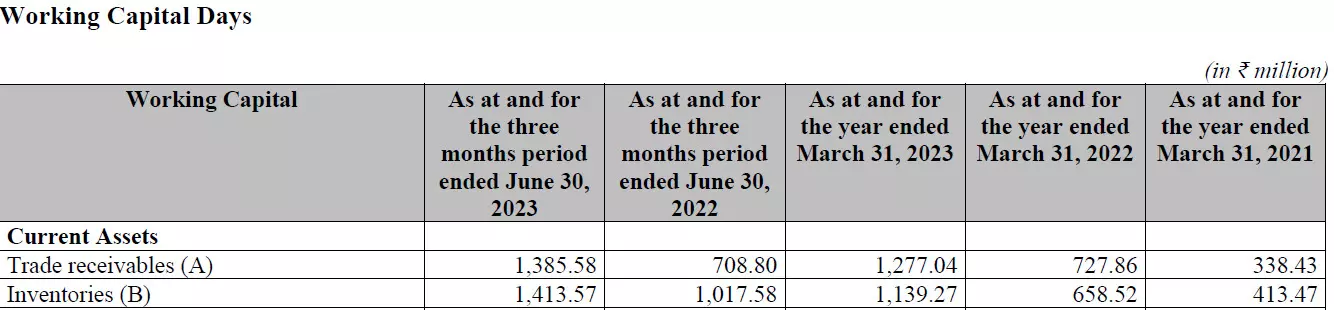

According to Honasa's own Red Herring Prospectus (RHP) filed last year, its inventory with distributors in FY2021 and FY2022 stood at Rs 41.34 crore and Rs 65.85 crore, respectively. However, in FY2023, this figure surged to a staggering Rs 113.92 crore, nearly double the previous year.

By the quarter ended June 30, 2023, inventory with distributors had reached Rs 141.35 crore. The sudden growth in inventory shows that Honasa was clearly pushing way too much more inventory than before, and experts The Core spoke with said that this is a problematic trend in the P&L statement.

The Core has reached out to Mamaearth and will update the story when they respond.

Mamaearth's Inventory Illusion

Many D2C brands employ what can be seen as an aggressive accounting strategy, booking initial sales to distributors or stockists as complete revenue, even when those sales include potential returns. This practice can create an inflated picture of revenue, especially for brands experiencing rapid growth.

A national sales head of a large D2C firm speaking on condition of anonymity told The Core that this revenue recognition approach works well for a larger brand where demand is high and inventory returns are low. Large established brands typically expect inventory returns only between 2-7% every quarter. They always provision their books in advance for these returns spread over multiple quarters rather than taking a hit in one go in a single quarter. Problems arise when sales decline or products don't move off the shelves.

“Retailers and distributors may sometimes seek to return unsold goods, forcing the D2C brand to adjust its initially recorded revenue. This can be particularly challenging for brands… Essentially, while booking primary sales as revenue is not inherently problematic, it becomes an issue when returns are high and adjustments are necessary. This situation underlines the importance of accurately reflecting actual sales to end consumers, as those are the sales that truly matter for a brand's long-term success,” added the source from the D2C firm.

Therefore, the record revenues and profitability reported by Honasa in Q1FY25 and previous quarters, achieved through this revenue recognition practice — recording revenue at the point of handover to distributors — are red flags.

Sudarshan Bhandari, an independent chartered accountant closely tracking Mamaearth, highlighted a critical inconsistency in the company's narrative. He explained that while Mamaearth attributed its Q2 losses to a change in distribution strategy, the reality is more complex. "They pushed inventory to super stockists before the IPO to present a better picture," Bhandari notes, "and now they're taking it back, impacting their financials." He argues that this manoeuvre, coupled with the company's aggressive revenue recognition practices, was done to present a rosier picture of their financial health and entice investors prior to the IPO.

This practice, commonly known as "channel stuffing," involves pushing excess inventory onto distributors to artificially inflate sales figures. "At the time of the IPO, despite pushing inventory to super distributors, their (Honasa's) inventory had increased by 40% year-on-year due to the introduction of newer brands without acknowledging the rising inventory caused by lower volume growth," Bhandari explains.

While Honasa claimed that the Q2FY25 losses were because of a one-time inventory correction, Bhandari pointed to inconsistencies between their statements and the actual numbers. “Even after factoring in the Rs 63 crore correction, the reported 6% revenue growth in Q2FY25 fell short of market expectations. These discrepancies suggest that the challenges facing Mamaearth run deeper than a simple inventory adjustment,” Bhandari said.

Distribution Overhaul Gone Wrong

By July 2024, Mamaearth's distributors began raising concerns about this aggressive inventory push. The All India Consumer Products Distributors Federation (AICPDF) told various publications that despite their best efforts to push products into the retail market, inventory worth Rs 50 crore to Rs 100 crore remained unsold. The association further revealed that distributors stocking Mamaearth products were burdened with 90 days' worth of unsold goods, some nearing their expiry dates.

Dhairyashil Patil, national president of AICPDF, revealed that over 200 distributors across India are grappling with unsold Mamaearth inventory. He expressed concern that despite Mamaearth's claims of addressing the issue and initiating product returns, many distributors have yet to receive refunds or adjustments for the unsold stock.

"In the two quarters, they have done more than 100 crores of adjustment via stock returns from these 200-plus distributors, and now they are saying we are only outstanding with 60 crores," Patil stated, highlighting the discrepancy between Mamaearth's claims and the reality faced by distributors.

In response to allegations of over Rs 100 crore in unsold inventory, Mamaearth had issued a clear denial, providing detailed information in their stock exchange filings to refute the claims made by the AICPDF.

"We have actively and transparently addressed our transition to a direct distribution model during our results for Q2FY25, proactively taking back inventory from discontinued distributors. Total returns, including provisions for subsequent returns, totalled to INR 63.52 cr. Of these, the company has already received returns worth INR 41.21 Cr in its warehouses, while balance returns of INR 21.32 are in the process of being picked up from the concerned distributors," Mamaearth's statement to the stock exchange said.

Strained Distributor Networks

To entice distributors in the competitive offline retail market, emerging D2C brands often offer higher margins than those provided by established players. This tactic is crucial for new brands looking to gain a foothold in the market and secure shelf space. However, building trust with distributors goes beyond just offering attractive margins. It requires a long-term commitment to fulfilling various obligations, such as timely collection of unsold and expired stock, prompt settlement of credits, and maintaining clear communication.

Deep Bajaj, founder of personal care brand Sirona, emphasised the importance of establishing a strong relationship with distributors. He said that "the easiest thing is to find a distributor and show him the dream that…my products are selling a lot online and it will sell offline as well”. Bajaj warned that brands must follow through on their promises and ensure that products move smoothly through the distribution channel.

The source from another large D2C brand quoted earlier in the story also echoed this sentiment, highlighting the complexities of managing inventory in the offline retail model. He explains that "when you pass on the inventory, then the whole unsold stock, expired stock, damaged stock, they start moving back, and that is where the whole inventory becomes very, very difficult." He stressed that brands needed to have clear agreements with distributors regarding unsold goods and a robust system for handling returns and credits.

Mamaearth's relationship with super stockists and some of the largest distributors in the country appears strained. The Core interviewed two super stockists who worked with Mamaearth, and they revealed ongoing struggles to return unsold inventory to the company that has been accumulating since September 2023 when Mamaearth began aggressively pushing inventory to them. Both distributors preferred to remain anonymous, declining to comment publicly on the brand.

One of them, based in Karnataka, shared their experience with the company's aggressive inventory push leading up to its IPO. In September 2023, the stockist received Rs 1.8 crore worth of inventory in just four days. Despite efforts to sell the products, only Rs 10 lakh worth was sold in the following three months. Frustrated by the low demand and lack of support from Mamaearth, the stockist requested a return of the unsold inventory. However, it wasn't until July 2024, under Project Neev, that Mamaearth finally collected the remaining inventory.

"It was a regular practice of dumping too much inventory... They eventually took back the inventory... because I told them that there was very low demand for their goods,” said the Mamaearth Super Stockist based in Karnataka.

The Karnataka-based stockist also expressed concerns about Mamaearth's rapid product launch strategy. An aggressive approach, combined with a perceived lack of understanding of regional market needs, resulted in irrelevant products being pushed into areas where they were unlikely to sell, the distributor added.

"Every month they are introducing three to four products... they pushed SKUs of all this prior to IPO and after IPO as well," the stockist revealed, highlighting the constant influx of new products. This strategy, coupled with inadequate market research, led to mismatched products being distributed in various regions he alleged.

The stockist cited a specific example of the company pushing to sell body lotion worth Rs 25 lakhs in areas such as Ballri and Gulbarga where temperatures range between 35-40 degrees Celsius. “They pushed 60-70 cases of it to wholesalers. These markets don't experience winter season; then why push body lotions to this target group?," the stockist asked

Mamaearth's Offline Dilemma

However, Bhandari's analysis further reveals that the wave of inventory returns significantly impacted Mamaearth's Q2 FY25 financial performance, leading to their first loss in five quarters. He noted that during the Q2FY25 earnings call, management admitted to underestimating the impact of the inventory correction, attributing it to an unanticipated volume of returns and unaccounted-for market credit.

Bhandari explained that the substantial impact on the company's EBITDA margin raises further red flags. While Mamaearth attributed the impact to the loss of gross margin on returned products and provisions for inventory-related issues, Bhandari argues that these explanations do not fully address the magnitude of the issue or the discrepancies between initial projections and actual figures.

“The scale of the write-off and the company's struggles to present a coherent and consistent narrative regarding these inventory issues have significantly undermined investor trust and raised concerns about their transparency and financial management practices,” Bhandari added.

While Mamaearth initially gained prominence as a digital-first brand, its reliance on online channels has been steadily declining. Honasa's RHP filed prior to its IPO reveals a clear trend: online sales, which once constituted the majority of its revenue, have been shrinking. In FY2021, online channels accounted for 81.37% of Honasa's revenue. However, this figure dropped to 69.91% in FY2022 and further decreased to 59.36% in FY2023. This indicates a strategic shift towards offline channels and a growing dependence on traditional retail distribution.

The company's aggressive push to expand offline, coupled with questionable inventory management practices and strained distributor relationships, has cast a shadow on its once-bright prospects.

As Bhandari aptly points out, "The problem is much bigger... So there might be a lot more returns coming from that channel also, which we may learn about in the next few months/quarters." This looming uncertainty, combined with declining online sales and a slowdown in the FMCG sector, poses a significant challenge for Mamaearth.

Mamaearth's aggressive inventory push before its IPO and subsequent struggles with unsold stock raise questions about its financial health and transparency, jeopardising its transition from an online brand to a retail powerhouse.