Trade War Tensions Hit Home: RBI Cuts Forecast, Loosens Credit Rules

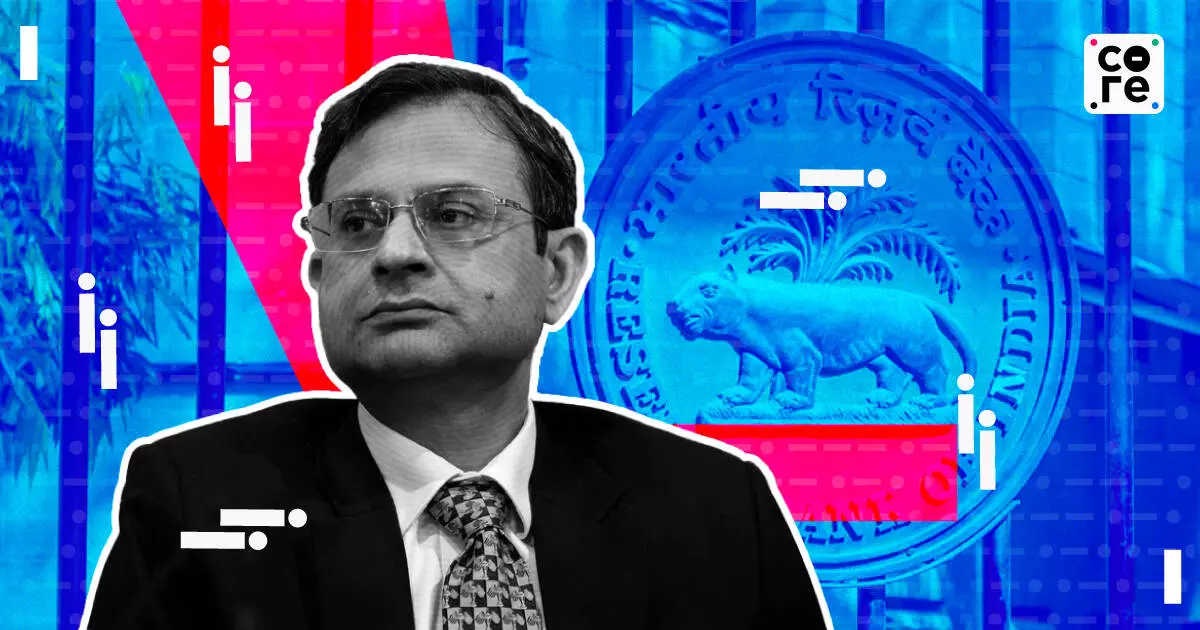

Reserve Bank of India's governor Sanjay Malhotra opened the central bank’s first monetary policy review of FY26 with stark warnings about US tariffs and its uncertainty

Reserve Bank of India (RBI) governor Sanjay Malhotra opened the central bank’s first monetary policy review of FY26 with a stark warning: global trade tensions, particularly the US’s newly imposed 26% tariff on Indian exports, pose a serious risk to India’s domestic growth.

“Trade frictions will impede global growth,” Malhotra said, adding that this will directly affect India’s net exports. He particularly explained that merchandise exports are likely to take a hit, while services exports are expected to remain resilient.

The governor also stressed that uncertainty in global trade is itself a drag on the economy, as it dampens growth by affecting investment and spending decisions of both businesses and households. This could potentially slow activity across the manufacturing and services sectors.

"Merchandise exports will be weighed down by global uncertainties, while services exports are expected to remain resilient. Headwinds from global trade disruptions continue to pose downward risks,” Malhotra added.

To sustain growth amid mounting global headwinds, the RBI’s Monetary Policy Committee (MPC) unanimously voted to cut the repo rate by 25 basis points to 6% — the second cut in two months. The RBI also signalled that this may not be a one-off move, since it has changed its policy stance from “neutral” to “accom...

Reserve Bank of India (RBI) governor Sanjay Malhotra opened the central bank’s first monetary policy review of FY26 with a stark warning: global trade tensions, particularly the US’s newly imposed 26% tariff on Indian exports, pose a serious risk to India’s domestic growth.

“Trade frictions will impede global growth,” Malhotra said, adding that this will directly affect India’s net exports. He particularly explained that merchandise exports are likely to take a hit, while services exports are expected to remain resilient.

The governor also stressed that uncertainty in global trade is itself a drag on the economy, as it dampens growth by affecting investment and spending decisions of both businesses and households. This could potentially slow activity across the manufacturing and services sectors.

"Merchandise exports will be weighed down by global uncertainties, while services exports are expected to remain resilient. Headwinds from global trade disruptions continue to pose downward risks,” Malhotra added.

To sustain growth amid mounting global headwinds, the RBI’s Monetary Policy Committee (MPC) unanimously voted to cut the repo rate by 25 basis points to 6% — the second cut in two months. The RBI also signalled that this may not be a one-off move, since it has changed its policy stance from “neutral” to “accommodative”

The move comes as the RBI expects Consumer Price Inflation (CPI) to be within a 4% target, down from 4.2% in February, as crude prices continue to soften, giving the central bank room to ease policy without stoking price pressures.

Adding to the developments, External Affairs Minister S Jaishankar on Wednesday said that India is actively engaging with the United States to finalise a bilateral trade agreement, potentially by the fall of this year. Speaking at a public event on Wednesday, Jaishankar said that the full impact of the tariffs is still unclear, but claimed that India, in principle, has reached an “understanding” with the US since President Trump returned to office.

Protecting Against The Unknown

Compounding the challenge, he said, are several “known unknowns” — the elasticity of India’s export-import demand, the shape of retaliatory policies against US tariffs, and the still-evolving free trade agreement (FTA) negotiations with the US.

Due to these concerns, the RBI has also revised its growth forecast for FY26 to 6.5%, down from 6.7% in February, pointing to the rising uncertainty and tariff-related risks weighing on the outlook.

“Given the numerous moving parts, forecasts are now less reliable,” said Dharmakirti Joshi, Chief Economist at Crisil. “Nonetheless, in our base case, we project India to grow at 6.5% with risks tilted to the downside and inflation rate of 4.3% in fiscal 2026. The downside risks to growth come from rising uncertainty, which impairs decision making, and the impact of tariffs and slowing global growth on exports.”

Vivek Iyer, partner at Grant Thornton Bharat, echoed similar concerns, noting that the tariffs have already dented global demand and sentiment, and warned that supply chain risks could weigh on domestic demand by pushing up input costs for Indian companies. He added that while the rate cut was warranted given the evolving risks, it may elevate currency volatility and inflation.

“We expect the RBI to look at measures that will help build foreign exchange reserves in the country on a continuous basis to help tide over the uncertainties that pose the world today," added Iyer in a statement.

Regulatory Revamp

Beyond the macro signals, the RBI also announced a set of regulatory measures that fintech lenders and payments players are calling game-changing. One of the most notable was the decision to extend co-lending guidelines to all regulated entities, not just NBFCs. This is particularly significant for fintechs like Slice and BharatPe, which have so far stuck to co-branded credit cards and unsecured personal loans, largely due to capital constraints and operational complexity.

With the new framework, these players can now partner with banks to offer larger-ticket credit products — including auto loans, home loans, and even B2B financing — without having to build full-scale lending operations themselves. “This simply wouldn’t be viable for smaller players to do independently. Co-lending changes that,” said Arvind Datta, founder of Marigold Wealth, told The Core.

On the payments side, the RBI’s move to give NPCI flexibility to revise transaction limits on UPI merchant payments was also welcomed. “If these limits are increased, it will pave the way for higher-value use cases — from college fees to hospital bills — to move onto UPI,” said Anup Agrawal, CEO of Kiwi. He added that the move allows TPAPs to partner with a wider base of merchants and expand high-ticket digital payments in a system users already trust.

Reserve Bank of India's governor Sanjay Malhotra opened the central bank’s first monetary policy review of FY26 with stark warnings about US tariffs and its uncertainty