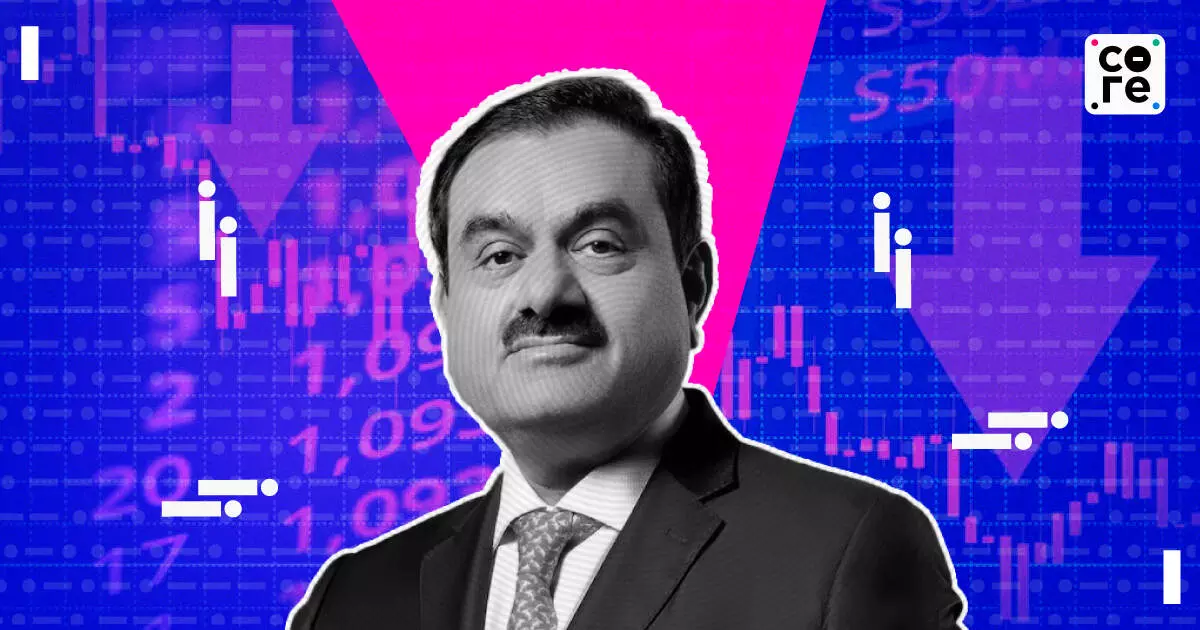

Adani's Teflon Coating Wearing Thin?

Adani's Teflon coating is wearing thin as US bribery charges and market scepticism cast a shadow over the conglomerate's future, despite its history of weathering controversy.

The responses to bribery allegations against the Adani Group that exploded across newswires early Thursday morning came from several, mostly predictable, quarters.

But this one took the proverbial cake.

The India research head of investment and wealth manager, Sanford Bernstein, said the market reaction—the fall in Adani’s stocks by around 20%—was short-term.

“These incidents were not specific to India. Such incidents tend to be short-term in nature, given the nature of the infrastructure business,” the research head told CNBC TV18.

He dug in further, saying they were not reading too much into the Adani Group news and that the news was unlikely to have lasting consequences for the broader market. Instead, he said, they were focused on the broader solar sector and said solar energy was a domestic and export opportunity.

If I were to decode what he said, it would go as follows.

First, that allegations of corruption should be treated as routine because that is the nature of the infrastructure business in India. In effect, brokerages like his were building corruption into their sector analysis and modelling– my words not his.

Second, because such allegations or brouhahas are routine, it will be back to business as normal in a few days or so.

The frightening part is that he may be right.

Everyone assumes that large contracts are not landed without some form of give a...

The responses to bribery allegations against the Adani Group that exploded across newswires early Thursday morning came from several, mostly predictable, quarters.

But this one took the proverbial cake.

The India research head of investment and wealth manager, Sanford Bernstein, said the market reaction—the fall in Adani’s stocks by around 20%—was short-term.

“These incidents were not specific to India. Such incidents tend to be short-term in nature, given the nature of the infrastructure business,” the research head told CNBC TV18.

He dug in further, saying they were not reading too much into the Adani Group news and that the news was unlikely to have lasting consequences for the broader market. Instead, he said, they were focused on the broader solar sector and said solar energy was a domestic and export opportunity.

If I were to decode what he said, it would go as follows.

First, that allegations of corruption should be treated as routine because that is the nature of the infrastructure business in India. In effect, brokerages like his were building corruption into their sector analysis and modelling– my words not his.

Second, because such allegations or brouhahas are routine, it will be back to business as normal in a few days or so.

The frightening part is that he may be right.

Everyone assumes that large contracts are not landed without some form of give and take. Specifically, no one really thinks you are corrupt because you got a big power distribution contract at a price that the electricity distribution company, including the one in question, may not otherwise have bought.

All this is priced into the stock price eventually. Since this is a discussion on business and market price and not morals, let us focus on the former. Which is that Adani Group stock prices tanked more than 20%–no mean feat even in a generally weak and sliding market.

But before we go deeper into that, let’s pause to take stock of the allegations.

US Government prosecutors have charged Gautam Adani with helping drive a US $250 million bribery scheme to Indian government officials to win solar energy contracts and concealed the plan as they sought to raise money from US investors, Bloomberg reported.

More specifically, the Securities & Exchange Commission (SEC), which controls securities markets in the USA, has said that during Adani Green’s September 2021 note offering, which raised US $750 million, the offering materials misrepresented the company’s anti-corruption efforts, despite ongoing bribery activities.

The five-count indictment also accuses Gautam’s nephew, Sagar R. Adani, and Vneet S. Jain, both executives at an Indian renewable-energy company, of breaking federal laws.

Adani has denied the US allegations and said it would seek legal recourse, even as it scrapped a $600 million bond sale.

There have been other collateral damages, including to the holdings of several mutual funds, which took what seemed like contrarian bets on the Adani Group.

Which brings us to the price.

While the debates are already turning shrill, with considerable political grandstanding, the fact remains that the markets, where the ultimate power lies, have voted down the Adani stock prices again.

This is the third, perhaps major, shock to the company’s reputation and its stock prices, starting in January 2023 when New York-based short-seller Hindenburg Research claimed in a report that Adani was involved in stock manipulation, accounting fraud, and money laundering. The report also alleged that the Adani Group was using offshore shell companies to inflate its stock prices and hide its true ownership structure.

A long investigation by the Securities & Exchange Board of India (SEBI) has gone pretty much nowhere, and allegations that the SEBI chairperson, Madhabi Puri Buch, had prior links to the Adani Group and may have influenced SEBI's investigation have also not really touched anyone. These allegations, also made by Hindenburg in a follow-up report in August 2024, claimed that Madhabi Puri Buch's husband had hidden stakes in offshore funds linked to the Adani Group.

It is highly unlikely that any other company or business group could have survived such scrutiny.

But the markets don’t care. In each instance, Adani Group stock prices have been hammered to the floor.

Kotak Alternate Asset Managers have said they have advised exercising caution with Adani Group stocks, following the recent correction.

Serious bribery allegations have been levelled by the US Prosecutors directly against the Chairman and his nephew. Also, this development raises valuation concerns, particularly for PSU banks that have extended credit to the group.

And it's not just equity.

Moody’s Ratings said that the indictment of the Adani Group's chairman and other senior officials on bribery charges is credit negative for the group’s companies

“Our main focus when assessing the Adani Group is on the ability of the group’s companies to access capital to meet their liquidity requirements and on its governance practices,” Moody’s Ratings said in a statement

Given Adani’s past record of managing its problems within India, it will perhaps emerge unscathed from this round of battering too.

But the markets clearly know and neither forgive nor forget.

And that is something the Adani Group cannot easily negotiate or navigate its way out of easily. This is the third time unlucky for the group.

Adani's Teflon coating is wearing thin as US bribery charges and market scepticism cast a shadow over the conglomerate's future, despite its history of weathering controversy.