‘First, Do the Homework’ Say Experts As India Eyes Small Aircraft Manufacturing

India’s ambition to build its own regional aircraft is bold, but without clear data, realistic planning, and sustainable demand, experts fear it could be more dream than deliverable.

India’s civil aviation minister Ram Mohan Naidu has had a busy few months. First, he promised a boom in regional airports. Then, he revised India’s projected pilot needs to 20,000, before later increasing the estimate to 30,000 in the coming years.. Now, he’s upped the ante yet again, saying India wants to manufacture its own regional aircraft.

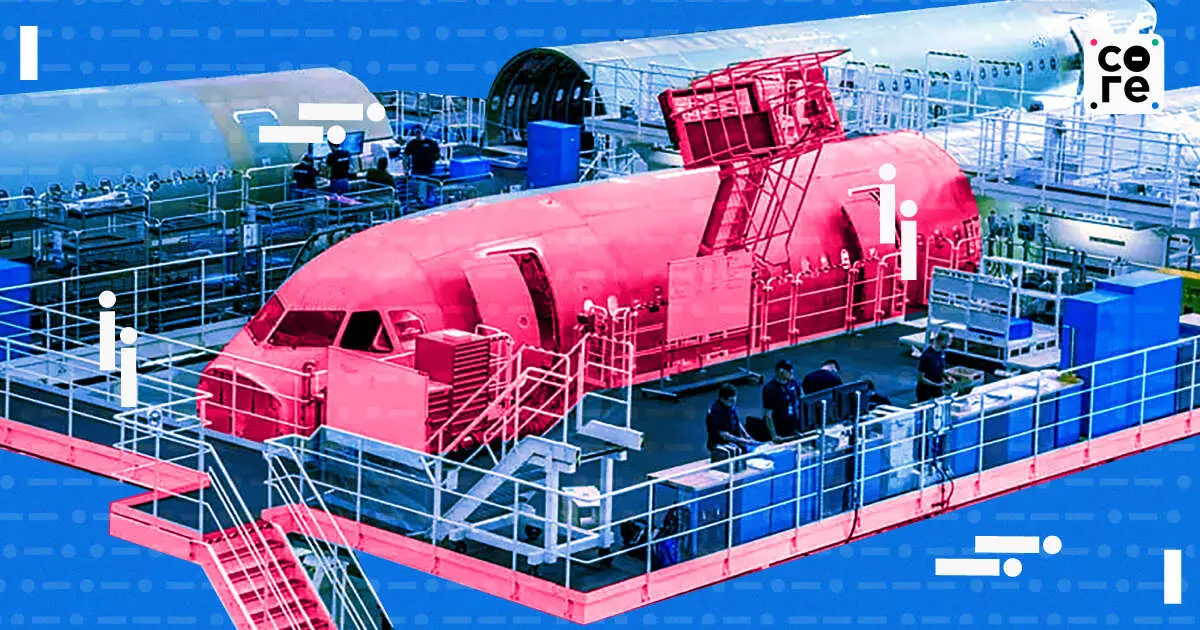

This is a country that has long depended on foreign aircraft manufacturers. Last month, Naidu announced that a special purpose vehicle (SPV) will be set up to make regional transport aircraft, a move that could place India on the global aerospace map. He said it was his dream to manufacture aircraft in India.

Speaking in the Rajya Sabha, Naidu said the government believes India was ready to take on design, manufacturing, and maintenance of aircraft, backed by policies already in place. The SPV, which will unfold over the next five years and bring together industry stakeholders, will conduct a situational analysis and develop a roadmap for production, all under the ‘Make in India’ umbrella.

According to the government, under the UDAN scheme, over 500 regional routes have been awarded to enhance air connectivity across India, though many of these routes are yet to be fully serviced.

The government also has plans to expand airport infrastructure, adding more than 100 new airports by 2030, many of which are being developed in underserved and remote regions to support regional aviation growth.

But can India really manufacture aircraft? Experts The Core spoke to believe that India should not jump in without solid data, clear demand forecasts, and real industry buy-in.

“The ministry has to conduct a thorough analysis: How many aircraft are required? What kind? What’s the lead time for manufacturing? And who will manufacture — private players, HAL, or a consortium? There's also the question of maintenance, spares, and long-term support,” said Jitender Bhargava, former executive director of Air India, told The Core.

The Reality Check

India’s need for regional transport aircraft is growing rapidly, driven by a mix of government initiatives like UDAN (Ude Desh ka Aam Naagrik), increased connectivity to tier 2 and tier 3 cities, and the overall aviation boom.

What qualifies as ‘regional’? Typically, aircraft with 30-90 seat capacity flying distances under 1,000-1,500 km, like the ATR 72, De Havilland Dash 8, or the upcoming HAL-developed aircraft like the Hindustan 228 and the 70-seater RTA-70.

While the ambition is clear, industry veterans are quick to point out that India needs more than just policy muscle. It needs data, market research, and most importantly, sustainable demand.

When ministries began developing airports across the country, Prime Minister Narendra Modi had noted that the number of operational airports jumped from 74 to 150. That growth clearly aligns with the National Civil Aviation Policy, focusing on cities that were previously underserved or entirely unserved.

Naturally, once the airports are built, the next step is airlines, aircraft, and market connectivity.

“Sometimes airlines and aircraft come bundled, but the real question is — how do you make it all work?” Bhargava said.

Bhargava pointed out that airport infrastructure alone isn’t enough — India also needs realistic demand mapping.

“Take Uttar Pradesh as an example. It now has 19 airports. But how many flights can realistically operate across those—Kanpur, Lucknow, Allahabad, Ayodhya, and others? That’s where demand analysis and market research come into play. And then there’s the aircraft question,” he said.

The Core had previously highlighted how India's regional airports were facing operational and financial hurdles, with many struggling to attract airlines and passengers despite government efforts to boost connectivity.

“The 90-seater model will mostly be passenger-focused, sure, but it really depends on the route you want to deploy it for. And here’s the crux: you can’t manufacture an aircraft unless you have the ecosystem to support the supply chain behind it,” Mark Martin, founder and CEO of Martin Consultancy, told The Core.

Learning From The Past

India isn’t completely new to aircraft manufacturing. Hindustan Aeronautics Limited (HAL) was assembling Dornier aircraft decades ago. But the results weren’t exactly world-class. Bhargava believes the moment has come to rethink everything—from aircraft type to market fit.

“Let’s not forget—HAL was manufacturing Dornier aircraft 20–25 years ago. Sure, that was a different era, a different India. Maybe the aircraft weren’t world-class, maybe the production was slow—but that’s not the point. Today, we can reimagine what we want to build and how many aircraft we need. But that requires solid data,” he said.

And the big question remains: What kind of aircraft numbers is the Ministry of Civil Aviation targeting, and is there solid research backing those figures?

“When we talk about aircraft manufacturing, we mean the entire aircraft. And one of the biggest components is the engine. As far as I know, there's been no concrete move toward engine manufacturing in India,” said an industry expert on the condition of anonymity.

While HAL began manufacturing aircraft in 1942, India has not kept pace with global leaders. Currently, the Indian regional aircraft market is dominated by European manufacturer ATR, with 67 aircraft operating in the country. IndiGo operates 45 of those.

HAL's Regional Jet Plan: A Glimmer of Hope?

The HAL/NAL Regional Transport Aircraft (RTA) project, nicknamed the Indian Regional Jet (IRJ), aims to seat 80–100 passengers, with cost-effective operations 20% cheaper than global peers.

The RTA-90, a 90-seater model, is under development and is expected to enter service by 2026.

But skeptics are cautious. “Look at the Indian Air Force — they’ve raised concerns about aircraft HAL, especially around timelines and delivery commitments. Sure, military and civil aviation are different beasts, but if even basic trainer aircraft face hurdles, we need to tread carefully,” Bhargava warned.

What Comes First: Development or Demand?

“Regional traffic is extremely price-sensitive in the early stages, largely due to the region’s level of economic development. As disposable incomes rise, price becomes less of a concern—but that rise only comes with development,” said Manish Sinha, aviation expert, told The Core.

Air travel can transform business efficiency, but only if it’s backed by proper infrastructure and connectivity.

“You may not need a 70-seater for a Nasik-Kolhapur or Nasik-Aurangabad route—a 30-seater might be more appropriate. Especially when you already have 100-seater aircraft operating in India,” Bhargava pointed out.

Both Sinha and Bhargava echoed the same concern—India lacks reliable data to plan demand-driven aircraft manufacturing. Without primary research, aircraft development could turn into a costly gamble.

For regional airports in particular, we first need to conduct solid demand forecasting. Right now, there's a clear data gap. In many smaller towns with airport potential, we simply don’t have reliable primary data to accurately forecast traffic or demand.

"So, what we do is use secondary methods to arrive at a more accurate forecast. We incorporate trends, like the fact that typically around 3-4% of total visitors in India travel by air. We've applied this approach for Ujjain Airport, where we didn't have any primary data on how many people actually flew into Indore to reach Ujjain. And even if we consider the available data, in my opinion, it isn’t enough. That’s because there's likely an additional 20-30% of potential passengers who might choose Ujjain or Mahakaal for religious tourism — if there was a direct flight," Sinha said.

Caution Over Celebration

From Ayodhya to Agra, many Indian airports lie underutilised despite their big tourism potential. Experts caution that initial spikes in traffic may not translate into sustainable operations.

And then there’s the reputation issue. “It’s easy to say we have the calibre and competence — but then why is the Indian Air Force Chief complaining about Hindustan Aeronautics Limited’s delivery schedule and lack of integrity? If we truly had everything in place, this wouldn’t be an issue. Let’s be honest — schedule discipline is non-negotiable,” Bhargava added.

India’s ambition to build its own regional aircraft is bold, but without clear data, realistic planning, and sustainable demand, experts fear it could be more dream than deliverable.

India’s ambition to build its own regional aircraft is bold, but without clear data, realistic planning, and sustainable demand, experts fear it could be more dream than deliverable.