The US Student Visa Crackdown Has Turned Study Dreams Into A Legal And Financial Gamble

Trump’s second term is triggering visa cancellations, OPT threats, and rising student loan risks, forcing Indian households to rethink the value of a U.S. degree.

When Donald Trump returned to power as US president in January 2025, there was little doubt among policymakers, student advisors, and visa experts that an immigration crackdown was coming. His campaign had laid it out in bold: stricter controls on foreign workers, tighter rules for visa overstays, and swift deportation of undocumented migrants. But there was also a widely shared assumption — almost a consensus — about the limits of this crackdown.

Study abroad counsellors, education financing platforms, immigration lawyers, and even Indian families settled in the United States told The Core — when we first reported on the issue in December — that the heat would be reserved for illegal immigrants, undocumented workers, or students who had overstayed their visas.

That assumption now lies in tatters.

In just three months, the Trump administration has weaponised the very systems designed to monitor legal student migration. Over 1,500 F-1 student visas have been revoked, and 4,736 Student and Exchange Visitor Information System (SEVIS) records terminated, affecting students across more than 240 U.S. universities, according to government and media

When Donald Trump returned to power as US president in January 2025, there was little doubt among policymakers, student advisors, and visa experts that an immigration crackdown was coming. His campaign had laid it out in bold: stricter controls on foreign workers, tighter rules for visa overstays, and swift deportation of undocumented migrants. But there was also a widely shared assumption — almost a consensus — about the limits of this crackdown.

Study abroad counsellors, education financing platforms, immigration lawyers, and even Indian families settled in the United States told The Core — when we first reported on the issue in December — that the heat would be reserved for illegal immigrants, undocumented workers, or students who had overstayed their visas.

That assumption now lies in tatters.

In just three months, the Trump administration has weaponised the very systems designed to monitor legal student migration. Over 1,500 F-1 student visas have been revoked, and 4,736 Student and Exchange Visitor Information System (SEVIS) records terminated, affecting students across more than 240 U.S. universities, according to government and media reports. The American Immigration Lawyers Association (AILA) has called it one of the most aggressive deportation waves targeting documented students in recent history.

Indians are bearing the brunt: nearly 50% of all visa revocation cases involve Indian nationals, according to several reports. And while some students are quietly flying home, others are lawyering up.

Crackdown No One Expected

In a case reported by Business Standard, an Indian student on the verge of deportation managed to block the move after his university intervened, and a Georgia District Court granted interim relief. Experts The Core spoke with now warn that this is “only the beginning” — a wave of litigation may follow, with international students now being advised to prepare for legal defence, even if fully compliant with their visa terms.

“The fear is real,” Poorvi Chothani, founder of LawQuest, told The Core. Even documented students are scared to leave the country in many cases, she pointed out. Chothani is a Mumbai-based immigration law firm that advises clients on US, Indian, and global immigration matters.

“What’s happening is if a student has had an adverse interaction with law enforcement— whether it's a driving under the influence (DUI), or even just a police report — that data is being picked up,” added Chothani.

So, what changed?

The answer lies in a digital database called the SEVIS, operated by the US Department of Homeland Security. SEVIS was originally intended to track international students and exchange visitors throughout their academic lifecycle.

According to a detailed Financial Express report, SEVIS is now being used to instantly flag students for deportation over even minor infractions, such as DUI charges, alleged misrepresentation in paperwork, or unauthorised off-campus work. Once flagged, Immigration and Customs Enforcement (ICE) agents can begin deportation proceedings with minimal prior warning. The result is a surveillance state for foreign students—real-time data monitored, flagged, and acted upon.

If a student's SEVIS record is terminated, they are immediately considered out of status — and therefore no longer legally allowed to remain in the United States. Chothani explained that such a change leaves very little room for manoeuvre, especially for students who aren’t close to graduation or lack legal support.

She suspects that the sudden wave of terminations is being driven by artificial intelligence. “There’s no other way the system could flag so many students so quickly,” she said, pointing to the limited manpower within the Department of Homeland Security. With only a handful of officers available to monitor thousands of records, it’s likely that SEVIS is now being cross-referenced against other federal databases using automated tools.

Growing Trust Deficit

Until recently, education counsellors and study-abroad advisors maintained a steady line: the United States remained the most sought-after destination, and student interest hadn’t meaningfully dipped. That stance is beginning to crack.

Rozy Efzal, director at Invest4Edu, a study abroad consultancy that offers integrated career counselling, profile-building, loan facilitation, and visa services, told The Core that “the anxiety touched the roof” as news of SEVIS terminations spread. “We’ve seen a real dip in interest for the US — it’s not just panic, it’s behaviour now,” she said.

In terms of search trends and platform data, the numbers tell a similar story. Invest4Edu’s website traffic for US-bound programmes fell by 30% post-January 2025, when Trump was sworn in. The share of student interest in US applications has halved, from 50% to just 26% in a matter of weeks. Meanwhile, Australia has surged ahead with 40-46% of total traffic, and emerging destinations like Luxembourg, the UAE, France, and Ireland are also seeing a spike in queries.

And while the US. still dominates long-term student aspirations — thanks to its university ecosystem, high job potential, and alumni network — Efzal admits that students are starting to build backup plans. “The favouritism towards the US hasn’t fully eroded,” she said, “but people are now searching for alternatives alongside it, not after.”

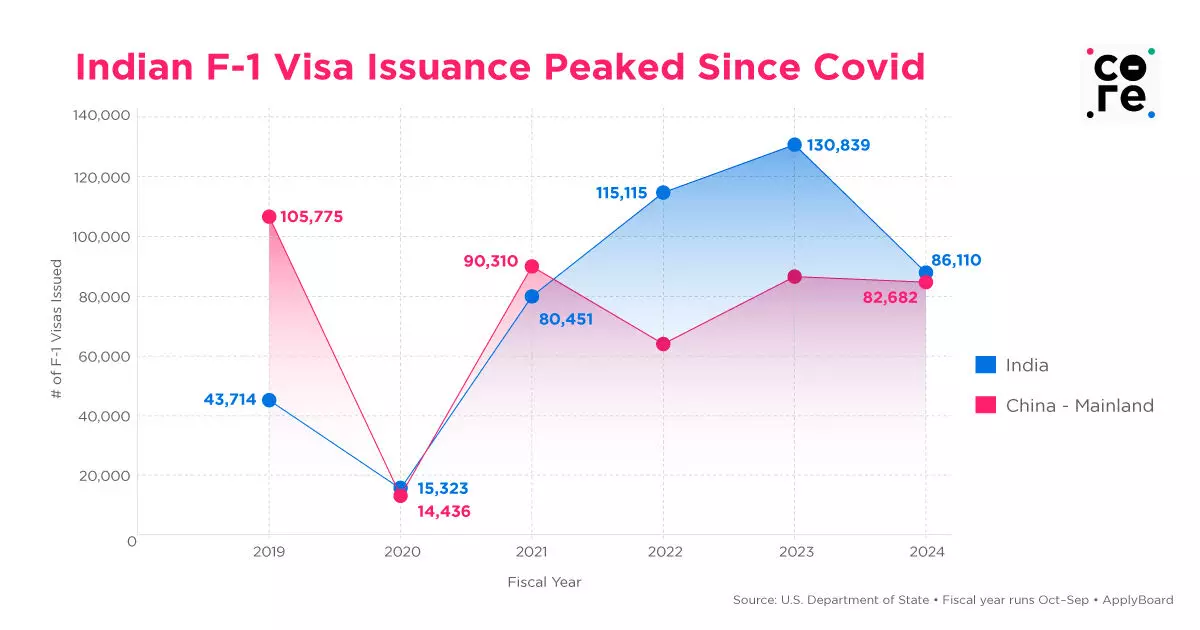

That behavioural shift coincides with a grim near-term outlook for F-1 visa issuance in 2025. While Invest4Edu declined to project absolute numbers, the platform estimates that after a 30-40% drop in FY24 compared to FY23, FY25 is likely to see a further decline. The reason? A mix of processing delays, policy unpredictability, and what Efzal described as “a lack of political predictability” in the U.S.

Financing, too, is beginning to reflect that caution.

In 2024, 95% of students on Invest4Edu’s platform inquired about loans, and about half were US-bound. But that number is shifting — and so is the willingness of lenders to underwrite risk.

Loan approvals for non-STEM programmes have notably declined, Efzal confirmed. Lenders are tightening criteria across the board — favouring applicants with strong academic records, prioritising top-tier university admits, and becoming far more conservative when reviewing visa-dependent repayment confidence.

US Edu Loans Now Risky?

If there's a post-study option that has kept the US on top of wishlists of Indian students, it’s the Optional Practical Training (OPT) programme.

OPT allows international students on F-1 visas to stay and work in the US for 12 months after graduation, with STEM (Science, Technology, Engineering, Mathematics) students eligible for a 24-month extension, giving them up to three years of work authorisation. It’s a crucial bridge — between classroom learning and H1B sponsorship, between repaying massive student loans and building global careers.

As Efzal of Invest4Edu pointed out, most Indian families choosing the US do so because OPT gives them “the safest harbour” when it comes to return on investment. It offers time to find a job, build a resume, and most importantly, repay loans taken in crores without having to leave the country within months of graduating.

But now, even that bridge is wobbling.

A Republican-sponsored bill, H.R. 2315, or the Fairness for High-Skilled Americans Act of 2025, introduced by Congressman Paul Gosar, seeks to terminate the OPT programme entirely. Gosar has argued that OPT, first formalised under former president George W Bush, acts as a loophole allowing foreign students to undercut American workers by accepting lower salaries, and also deprives the US of payroll tax contributions from employers.

To Indian students and stakeholders, however, this logic feels misplaced — and dangerous.

“OPT is the hook,” said Aman Singh, co-founder of GradRight, a platform that helps students match with universities and financing options. “Without it, the ROI on US. education, especially for master’s students, collapses. But my bet is that any blanket OPT is unlikely to happen.”

For most Indian students studying in the US, the journey is fuelled by a mix of partial scholarships and sizeable education loans, financed either through Indian banks or international lenders like GradRight and MPOWER Financing. As The Core reported in December, this model hinges on a high-stakes assumption: that students will land well-paying jobs immediately after graduation.

That assumption, too, is now under threat.

According to ForeignAdmits, the average loan size for a US master’s degree has touched Rs 40.6 lakh. UniCreds data from earlier years shows just how widespread this has become: over 56,000 students took education loans in 2021 alone, and across the last decade, Indian banks have disbursed Rs 39,268 crore to students heading abroad. Loan amounts typically range between Rs 10–50 lakh, with many families pledging property, land, or life savings as collateral. Collateral-free loans are usually reserved for those admitted to highly competitive programmes, often in top-tier universities.

Despite the growing chaos, most education lenders offering collateral-free loans to Indian students say they are not yet pulling back. Their underwriting models, which are currently geared to support students admitted into top-tier or highly ranked institutions, remain unchanged, at least for now.

If SEVIS terminations, visa cancellations, or work restrictions become more widespread, lenders may be forced to rethink their risk exposure, especially for students who rely on post-study work to service hefty loans. For now, lenders insist they are in wait-and-watch mode.

Part of the confidence, as Singh of GradRight explained, comes from where the impact is being felt most. “Most of the SEVIS terminations seem to be targeted at students who’ve come to the US to study in lower-tier colleges, which are only in the business to make money and not really of high academic quality,” he said.

Ticking Clock

If a student is removed from their course in the US mid-way through their education, it limits their ability to repay the loan.

However, they do have the option of studying on another campus outside of the US.

“If a student with an MPOWER loan does experience such an event, they will be able to continue their education, maybe on a Canadian campus, maybe even online…We work with some schools that have campuses abroad — for example, there's an increasing number of American universities that have campuses in Canada,” said Sasha Ramani, vice president of strategy at MPOWER Financing.

Scrapping the OPT will also dislodge repayment timelines. Singh of GragRight also explained that the clock starts ticking the moment students graduate. “Any disruption to OPT or H1B directly hits repayment timelines,” he said. “Most students have a 6–12 month cushion before repayments begin. Without income, that cushion evaporates.”

MPOWER, too, is monitoring the situation closely. “We haven’t changed our lending model yet,” said Ramani, “but we are absolutely preparing for scenarios where borrowers face new restrictions or delays in work authorisation.”

Even the quality of education—and the value it delivers—is now being scrutinised. An analysis in the India Forum notes that many US universities, facing rising costs and shrinking domestic enrolments, have expanded their master’s programmes, often with questionable quality and limited job prospects. STEM and business schools have grown class sizes dramatically, sometimes exceeding 1,000 students, even at prestigious institutions.

“If you look at the past few years' data, undergrads have been a small percentage of Indians coming to the US... Top universities don't have an issue filling undergrad quotas. But universities not in the top 100... might have a hard time, so they bring out more Master's programmes,” said Jugal Bhatt, a post-graduate student pursuing a master’s degree in computer science at the University of Illinois Urbana-Champaign.

For students like Bhatt, a master’s student in computer science at the University of Illinois Urbana-Champaign, the pressure is real. With over Rs 40 lakh in loans, the plan was clear: study, work under OPT, and build a life in the US.

According to an analysis by The Hindu, the chilling effect of Trump’s immigration crackdown is already visible in the numbers. In February 2025—the first month of Trump’s second term — the number of F-1 student visas issued to Indian nationals dropped by a staggering 30% compared to the same month the previous year, far higher than the 4.75% overall global decline. In contrast, visa issuances to Chinese, Japanese, and Vietnamese students fell by only 5–10%. Even more telling, the U.S. rejected 41% of student visa applications in 2024, nearly double the denial rate for all other visa categories — a deviation that experts fear might grow sharply in the coming months.

For thousands of Indian students who have taken loans with the expectation of working in the US after graduation, the biggest risk looming now is the potential repeal of OPT, a lifeline that bridges their education to employability. But even as panic builds, some observers urge caution. “It’s been introduced multiple times before by the same Republican lawmaker and hasn’t gained traction,” said Ramani, of MPOWER Financing. “We’re watching it closely, of course, but we don’t expect it to pass.”

Trump’s second term is triggering visa cancellations, OPT threats, and rising student loan risks, forcing Indian households to rethink the value of a U.S. degree.