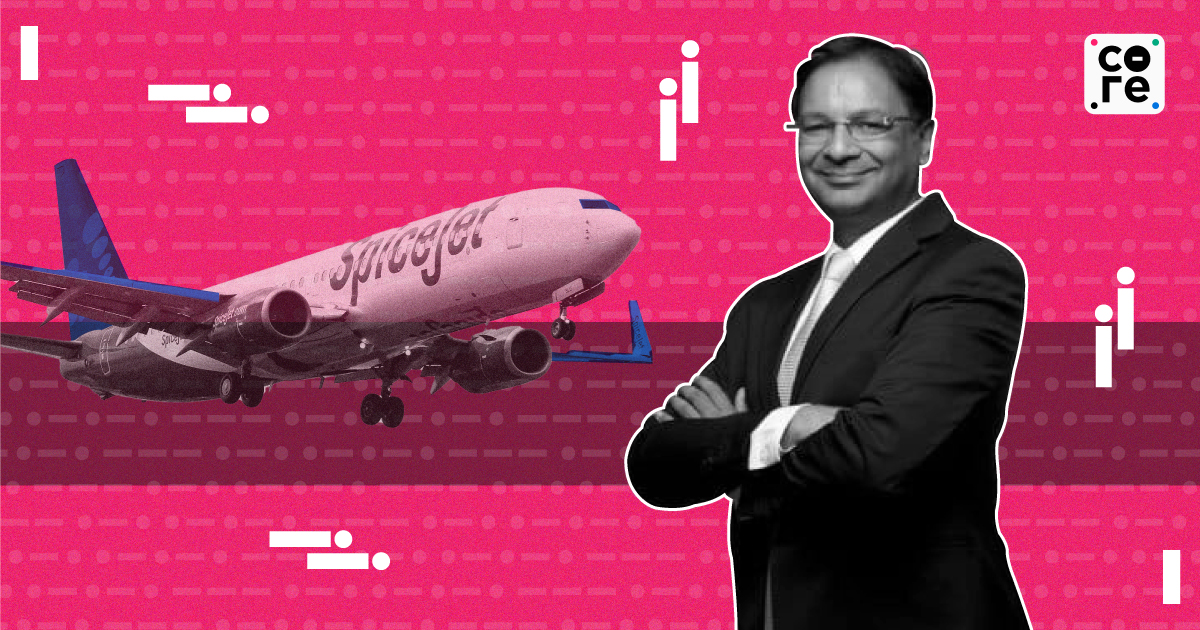

SpiceJet's Nine Lives: How Chief Ajay Singh Has Crossed Many Hurdles

- Business

- Published on 29 July 2023 5:30 PM IST

I don't know how many readers are familiar with the story of a cat who fell from the 32nd floor of a Manhattan high-rise and escaped with a chipped tooth and slightly damaged lungs. It lived to tell the tale so to speak - or at least its owner did! Agile, quick-witted and independent-minded, cats can survive falls that would kill most humans. This perhaps explains the phrase ‘a cat with nine lives'. This phrase struck me as apt in the context of the chairman and managing director of low-fare airline SpiceJet Ajay Singh, who has survived plenty of stumbles and falls in a tumultuous aviation sector in the last three years.

Ever since he took over the reins of SpiceJet from its previous owner Kalanithi Maran in 2015, Singh has seen a spate of good luck followed by an equally long spell of bad luck. With oil prices falling sharply almost as soon as he took charge, common sense and his understanding of the business helped him bring the airline back from the dead. By 2019, the airline had brought in its 100th aircraft and its share price had reached a peak.

Spicejet's lucky streak began to fade in 2019. First came the Lion Air and Ethiopian Airlines Max crashes and the subsequent grounding of Boeing 737 Max 8s across the globe, and then came the pandemic with the unending travails it unleashed for the entire aviation industry globally. Singh had called the grounding of the Boeing 737 Max 8s by the Directorate General of Civil Aviation (DGCA) a bigger disaster for the airline than the pandemic.

What's Leading To Fresh Equity Infusion?

To come back to last week's announcement of equity infusion, it is worth understanding how Singh's hand has been forced on this matter. It was reported last week that Singh will infuse ₹500 crore into the airline by subscribing to fresh equity or convertible instruments.

When he took charge at Rs 2, he was essentially taking on all the problems and liabilities the business had accumulated during Maran's tenure. Total losses had totted up to Rs 2,200 crore and immediate financial dues were almost Rs 1,300 crore. So even as the transfer of ownership happened for almost nothing, Singh asked the Marans to put in a substantial amount of money to clear up dues including tax liabilities and also provide some liquidity to keep the company running.

It is this Rs 578 crore - invested by the Sun Group at the time - which has come back to haunt him. At the time of handing control to Singh, the Marans felt that the business had potential, so an agreement was reached whereby SpiceJet would issue cumulative redeemable preference shares (CRPS) that would help them keep one foot in the door but did not offer them any voting rights and would help them recover the sum invested at the time of handing over control. These shares were not issued by Singh in time as promised and this is the matter that has now culminated in the Supreme Court asking the airline to pay Rs 389 crore immediately at a time when it is already hemmed in with all kinds of problems.

It is worth bearing in mind that while Maran may have felt cheated, he was very quick to adopt a rather aggressive stance against someone who bailed him out: the final takeover deal was signed in January 2015 and the case was filed in 2015 itself. Considering Singh was at the time still working on clearing up the mess created by the Marans, an arbitration at that juncture seems a trifle unfair and rushed to me. Some breathing time and an out-of-court settlement at that stage could have spared both sides the expense and the court's valuable time.

The court case and its eventual fallout is not yet fully clear but had the airline coughed up the Rs 75 crore the court directed it to pay towards interest in February 2023 and not been pennywise, pound foolish (bad legal advice, if you ask my inexpert view), it might not find itself in the boat it is today. The court gave the airline a sharp rap on the knuckles including calling it a "luxury litigation", referring to the battery of lawyers that represented SpiceJet versus the two representing Maran. As a rival CEO commented, "that alone tells you who is the guilty party here".

This final blow in the battle that commenced in June 2015 has forced Singh to announce the latest equity infusion of Rs 500 crore in the airline. At Rs 32 per share currently, the market capitalisation of the airline is approximately Rs 1800 crore. Of this, Singh's holding is around 59%, a majority of which is pledged against loans taken.

Too Little, Too Late?

Many industry observers argue that the infusion is "too little, too late" and with the industry dynamics fundamentally altered post-sale of Air India, the future of the carrier has never looked dimmer. The airline's total liabilities were Rs 9676 crore of which lease rental dues were Rs 3060 crore, as on September 30, 2022, the latest available figures. Against this, the airline's total assets as per its balance sheet are Rs 2000-odd crore. Its fleet is almost halved, with many aircraft on the ground at present. A pending aircraft order of Max remains in abeyance as the airline tries to rustle up the funds to induct more of them.

But luck has turned yet again and those who have been observing Singh's never-say-die attitude are now convinced he's not done yet. The latest equity infusion will help bring in Rs 206 crore more in emergency credit loan guarantee scheme (ECLGS) money, in addition to the Rs 1000 crore it already has over the last two years. This will help the airline add to its 42-45 operating fleet by bringing some of the 25-odd grounded planes back in the air. Loads on SpiceJet aircraft remain robust as ever, several of its entrenched routes are quite profitable and its cargo operations bring in cash. Although the carrier is delaying its results (Q1 and Q2 results will be announced together), many expect the airline to post operating profits, on the lines of IndiGo, especially in the present macroeconomic environment with strong traffic demand and low fuel prices. With the outlook for the coming months suddenly looking quite rosy, SpiceJet's decision to wet lease additional capacity to capitalize on the winter season is being viewed as a "bold, all out Ajay Singh style" move. As a former senior management member, who says he'd bet his money on the airline's survival, puts it: "if he goes down, he will do it in style".

Or perhaps with some luck on his side, he will prove to be the proverbial cat with innumerable lives.

Anjuli Bhargava is a Goa based writer and columnist, with over 25 years of experience in print journalism.

Newsletter

Newsletter Search

Search