Pandemic, High ATF Prices, Poor Management: Why Are India's Airlines Struggling?

29 Jun 2023 5:30 PM IST

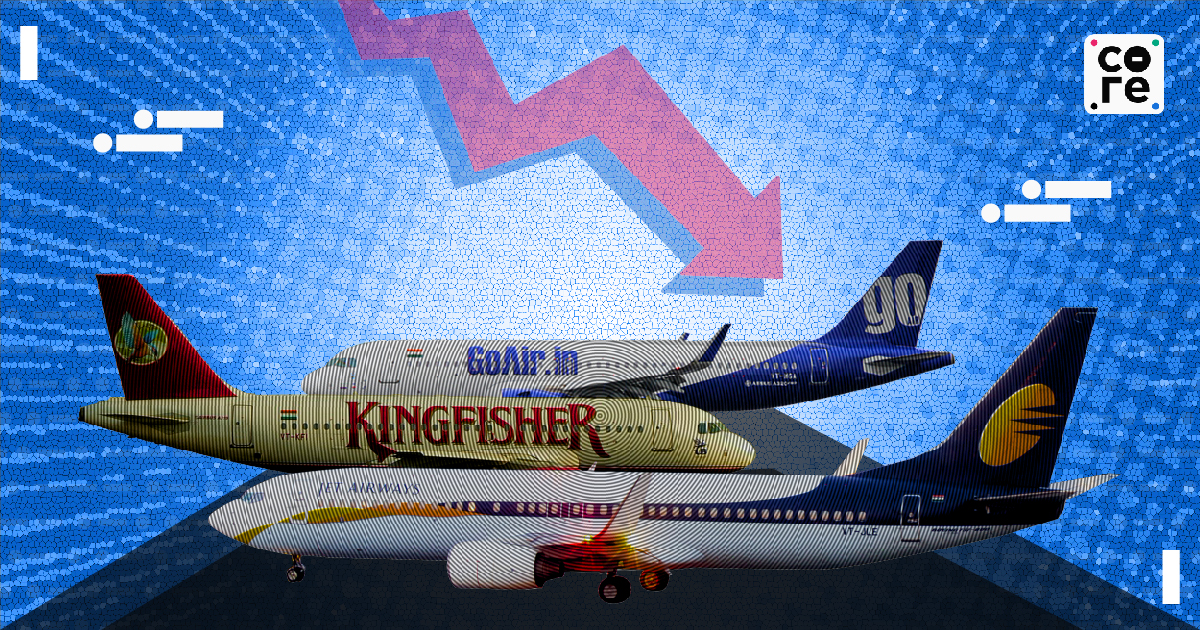

Kingfisher Airlines in 2012. Jet Airways in 2019. And GoFirst in 2023. The saga of India's tanking airlines seems to continue. So the question arises - is this only a case of inefficient management and bad business models or is there more than what meets the eye in India's aviation sector? Why do Indian airlines keep going bust ? What is wrong with this industry?

Over time, India has landed itself into a situation where airlines are caught in a vicious cycle of profitless growth. Most of the airlines do not make much or make almost no money from their core business of flying passengers. Airlines fly on various routes, tot up losses from core operations and then order more aircraft to fund the losses through sale and leaseback of planes.

Along the way, they occasionally earn some revenue through non-aeronautical activities. Even those who run their businesses well, rarely turn it into a profit. India's largest and best managed private airline IndiGo last reported a substantial profit of around Rs 2,200 crore in FY 2017-18.

Why the losses

A few factors have compounded the troubles of airlines. The pandemic followed by the Ukraine war and its fallout sent oil prices into a tailspin globally. The carriers in India have borne the brunt of this with aviation turbine fuel (ATF) prices rising almost 542 % since May 2020. This and other factors have led to a situation where the airlines have totted up combined losses of Rs 16,777 crore in FY 2021, Rs 20,000 crore in FY 2022 and is expected to exceed this number in FY 2023.

An absurd anomaly has made airline economics unviable, peculiar to India. Airlines in India pay more for fuel than their foreign counterparts do to refuel in India as they are charged the import parity price. Taxes upon taxes ensure that the total tax paid on fuel purchased in India climbs to around 20% since the states where the offtake is high - Delhi, Maharashtra, Tamil Nadu and West Bengal - the local excise rates vary between 20-25%.

Pleas to bring ATF under Goods and Services Tax (GST) have fallen on deaf ears. In most other countries with developed aviation sectors, if and when a similar tax is applicable, airlines are able to get input credit on the tax paid. India remains an anomaly in this regard.

To finance the losses that they routinely make through operations, airlines in India place aircraft orders to make some money from sale and leaseback of planes, whether they need them or not. This leads to more capacity being added in the market, which lowers fares further, making the economics even more unviable and resulting in more aircraft orders. This leads them into a vicious cycle of profitless growth.

Some of these losses in the past have been compensated by a high differential between the purchase price of the aircraft and the price at which it was sold to a lessor and then leased back for operations.

But over time even this sale and leaseback income has been on a decline. On every aircraft ordered, the difference which used to be US $ 8-9 million has almost halved. Nonetheless, this helps some of the airlines fund a part of their losses from flying.

Red flags

Poor governance and business practices compound the problem. It is evident that things are in disarray when an airline begins to cancel flights quite regularly and with little warning, when a large part of its fleet is on the ground for one reason or the other, when an airline's top management changes often, when founders interfere and impose on professionals to do their bidding or fights break out publicly between founders of the business.

Similarly, things are clearly not going well when an airline's lessors, vendors and suppliers begin to grumble publicly, when they are unable to pay oil bills, when the airline's auditors and chief financial officers change often, when staff and employees keep taking to social media to voice their never-ending grievances, when repeated attempts to raise money through the public or banks remain just that or when the tax and other statutory payments are not deposited to cite a few.

Then, when court battles seem to be the order of the day, when past promoters sue the current ones or when it becomes legally untenable for employees to leave with their dues paid and with dignity, one can safely assume this is not another day in paradise.

Where does the buck stop?

So, to argue that we can't do anything if businessmen run their affairs badly and in the process run their companies aground seems flippant or even callous since the wider repercussions of a failed business affect not just the aviation sector but India's standing and perception as a whole. This baby does fall squarely in the laps of governments since the industry remains a pretty regulated one worldwide.

Aviation veteran Gustav Bauldauf, who has worked with Jet Airways and Air India in the early and mid 2000s, points out that in Europe and other developed markers, the regulator steps in only if there is public damage. "Simply said, if there is no public damage, the regulator does not care if you lose money. However, if there is damage, the regulator confiscates whatever is available and will distribute it again to reduce damage. The problem is that companies try to hide their problems until it is too late to turn around, making things worse," he adds.

In the case of airlines, he points out, matters are a bit different than regular businesses as the customer is giving credit to the airline by buying tickets and is paying in advance, so if the airline is not fulfilling its part of the contract, a large number of people are invariably harmed.

The remedy

What therefore can the Indian government do to prevent yet another airline from declaring bankruptcy as we have seen in the last few weeks ? In the sector, many fear SpiceJet will be next in line, although the airline has issued a press release to deny the possibility.

One, develop a mechanism to conduct rigorous, regular and timely financial audits of the players. This can be done by someone other than the Directorate General of Civil Aviation (DGCA), which is in-charge of safety and yet to fully get its act together on this critical front. As of now, the DGCA is in a position to do such financial audits if it feels the airline's stress is impinging on safety. In 2018, many news reports said that such audits were carried out for Jet Airways but it clearly didn't help since the airline still went bust. So, while rules might exist, they don't work.

It is therefore critical that the Indian authorities figure out a way of professionally conducting such audits and asking the airlines to take steps or remedial actions based on the findings. This can be tallied with the data that privately held companies are required to submit to the ministry of corporate affairs to get a more complete position and accordingly recommend actions.

Two, assuming airlines in India have the right intent and want to build a robust business, they need to take a few steps to set their own houses in order. This requires an overhaul of governance within these airline companies and a strong, independent board that keeps a keen eye.

A Center for Asia Pacific Aviation (CAPA) report of March 2021, which talks of redefining aviation risk, points towards a series of operator related structural issues that need looking into. These include under capitalisation, poor corporate governance, leadership driven by individuals rather than institutionally, business models that deliver high costs and low yields, focus on market share rather than profitability, not investing in building people as assets and "institutionalized leakages".

Airline businesses, like schools, in India have consistently been used to siphon money out for personal use through a variety of methods and history has shown that promoters, founders and owners of airlines - both listed and privately held - have multiplied their wealth many times over even as the companies turn hollow and go bankrupt. The promoters of at least two carriers that have since gone bust - Kingfisher and Jet Airways are under investigation for such institutionalized leakages and financial irregularities by various government authorities.

A second option the government could consider is to mandate that all airlines - even budget ones - maintain a minimum cash reserve, which is sufficient to cover periods of crisis like the COVID-19 pandemic, sharp fuel hikes and other emergencies. Each time an airline registers a new aircraft, this reserve requirement must rise and be adhered to.

If some of these actions are followed through in the aftermath of this latest crisis, India's aviation sector might just have a rosier future than its past. Otherwise, very soon the rest of the world will not just be wary but will shy away from doing business with Indian carriers, leading to many repercussions that go beyond the scope of this article.

Anjuli Bhargava is a Goa based writer and columnist, with over 25 years of experience in print journalism.