Indian White Knights Eye The Sacred Summer

Indian Premier League franchise owners are lining up for their piece of the holy grail in franchise cricket: England's The Hundred competition.

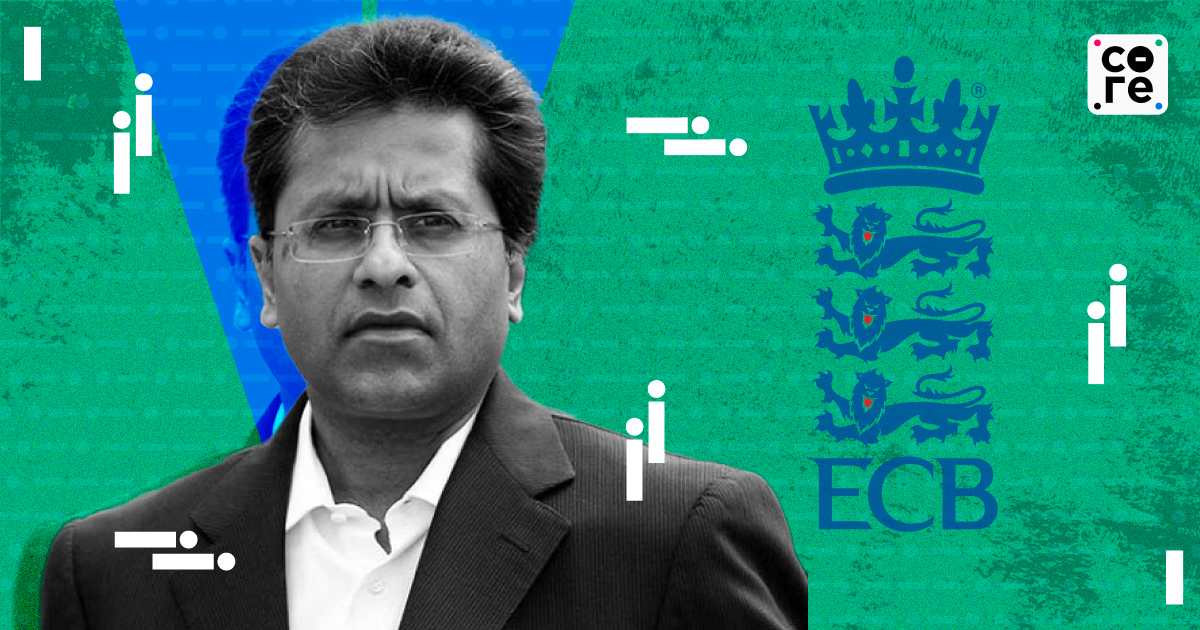

Last week, a report in the British newspaper The Daily Telegraph said that Lalit Modi, the founder and former commissioner of the Indian Premier League (IPL), had devised an audacious plan to bring private investment into English cricket. It would involve buying out the England and Wales Cricket Board?s (ECB) latest commercial product, The Hundred, for ?a billion dollars?.

Fearing that involving itself with Modi could endanger its relationship with the Board of Control for Cricket in India (BCCI), the ECB reportedly nixed the plan. In 2023, Modi was banned for life by the BCCI for alleged ?indiscipline and misconduct?.

But Modi, on his part, seems to be batting on. He told The Playbook in a WhatsApp text, ?I rather not comment on my plans now. But will let u know when ready [sic].? Modi, however, is not alone in expressing a keen interest in the English game beyond The Hundred, which is a literal 100-ball-a-side, eight-team tournament the ECB brought to life in 2021.

Unlike in the West Indies, South Africa, the United Arab Emirates, and most recently, the US, cricket in England has been untouched by the ambitions of IPL f...

Last week, a report in the British newspaper The Daily Telegraph said that Lalit Modi, the founder and former commissioner of the Indian Premier League (IPL), had devised an audacious plan to bring private investment into English cricket. It would involve buying out the England and Wales Cricket Board’s (ECB) latest commercial product, The Hundred, for “a billion dollars”.

Fearing that involving itself with Modi could endanger its relationship with the Board of Control for Cricket in India (BCCI), the ECB reportedly nixed the plan. In 2023, Modi was banned for life by the BCCI for alleged “indiscipline and misconduct”.

But Modi, on his part, seems to be batting on. He told The Playbook in a WhatsApp text, “I rather not comment on my plans now. But will let u know when ready [sic].” Modi, however, is not alone in expressing a keen interest in the English game beyond The Hundred, which is a literal 100-ball-a-side, eight-team tournament the ECB brought to life in 2021.

Unlike in the West Indies, South Africa, the United Arab Emirates, and most recently, the US, cricket in England has been untouched by the ambitions of IPL franchises keen to go global. But English cricket is in a financial flux, and it’s now looking to private investment, particularly in The Hundred, to revitalise its cricketing system. The near-dire situation will lure a bevy of IPL franchise owners—to what is the second-biggest market for cricket in the world—with a promise of increased revenue (from broadcast rights and sponsorship), plus a guaranteed presence on cricket-obsessed screens back home given the smaller gap in time zones. Add to that the opportunity of pursuing a not-so-secret desire among Indian franchise owners: to introduce year-round contracts for cricketers.

That wait will be over soon. Come April, the ECB is expected to decide on an expanded version of the tournament, with two new teams in England’s north-east and south-west. Private investors may also get to own up to 50% or 51% of a Hundred franchise, currently controlled by the ECB and the 18 of 20 powerful clubs that make up the bedrock of English cricket: the counties.

The Playbook spoke to eight people including sports management professionals, England-based cricket writers, and IPL team representatives for this story. Nearly all of them spoke on condition of anonymity because they weren’t authorised to speak to the media.

Dog Wagging The Tail

The story of English cricket in 2024 is that of two contrasts. The national team’s strategy has been to adopt a revolutionary path across formats, particularly in Test cricket, with an all-out embrace of a disruptive risk-and-reward approach popularly known as “Bazball.” But English cricket governance is anything but Bazball-esque: overly traditional, pedantic, and stuck in the 20th century—all of this even as England birthed Twenty20 cricket back in 2003 (but failed to trademark it), a format that would transform the sport and its business.

But the counties retained power despite the popularity of the T20 format. Or as a well-travelled English cricket writer puts it, “They do have the ECB by the b*lls.”

Here’s why. The ECB’s constitution is unique in that for any constitutional change, a resolution requires two-thirds votes of the counties and Marylebone Cricket Club. “It's like the dog being wagged by the tail. The counties have their ecosystem, and there’s a tension between them and the ECB,” the writer quoted above adds.

For instance, when The Hundred was first proposed in 2018, the concept was met with fierce resistance from the counties, who felt threatened by the proposal because they felt it would jeopardise their “sacred summer”, when they compete for first-class honours, a 50-over cup, and a Twenty20 tournament called the Vitality Blast.

To push The Hundred through, the ECB had to resort to a compromise: an annual financial handout of £1.3 million ($1.64 million). Even now, these tensions are simmering amid difficult financial times. And more so because several counties depend on ECB funding to survive; only three counties, Hampshire, Durham, and Northamptonshire, are privately run.

The situation is further compounded by the counties—other than those hosting international cricket—not having fixed assets they can monetise beyond a six-month summer when they earn via gate receipts or sponsorships. With inflation soaring in the UK, operating costs such as energy prices have shot up, while revenue has remained fairly constant. This is also why some counties are looking at alternative sources, including off-season events such as conferences or concerts on their grounds to earn more money.

That lure of extra revenue has prompted counties such as Leicestershire and Gloucestershire to either rebuild existing grounds or build new ones or build new grounds, or consider hospitality and similar facilities (eg: business hotels inside a ground) in the long run. Given their awareness that they likely won’t host an international game, these are big sources of ticketing revenue.

What this also means is that they have to invest to earn money. This in turn means that it’s increased their dependence on the money they receive from the ECB (and by extension, The Hundred).

Hence the fertile ground to attract private investment in The Hundred, which some county clubs believe could percolate back into English cricket and reinvigorate the system. In fact, in 2022, the ECB received a proposal from Bridgepoint Group to invest £400 million for a 75% stake in the tournament. It turned the proposal down, stating it was looking at “billions'' at the very least.

What To Buy?

IPL franchise owners have always coveted an opportunity to dip their toes into English cricket, either via investments or even partnerships. An early example came in the teething days of the tournament: in 2010, the Rajasthan Royals (RR), owned by Emerging Media, a UK-based company, got into a partnership with Hampshire to build what was then called a “World Franchise”. That plan was nipped in the bud, with no final agreement signed. Ten years later, even before a ball was bowled in The Hundred, Kolkata Knight Riders (KKR) CEO Venky Mysore stated that he’d evaluate an investment in the tournament should an opportunity arise. Now, that could become a reality.

According to multiple people The Playbook spoke to, KKR and RR are among “six or eight” franchises that are looking to The Hundred when the ECB’s timeline for private investment is specified. That shouldn’t come as a surprise, given that both teams own franchises in various leagues—Trinbago Knight Riders and Abu Dhabi Knight Riders (KKR), and Barbados Royals and Paarl Royals (RR). A recent Moneycontrol report stated that N Srinivasan’s Chennai Super Kings is also in contention, while last month, The Telegraph reported that the GMR Group, co-owners of the Delhi Capitals, were looking to buy into county club Hampshire—an unusual way of buying entry into The Hundred since it’s currently a loss-making property due to the financial handouts.

Even so, the supply-demand equation is heavily stacked in favour of Indian franchises that have both money and T20 franchise experience. Add that to the prospect of having a whole day of Indian audiences exposed to their brand (with The Hundred overlapping with the US Major League Cricket in July), and the ‘why’ of it all makes sense.

“What is for given is that they’ll attract the big sponsors. That’s the power of the brands they’ve built over the last fifteen years or so. Every big British corporation knows of Mukesh Ambani. Now imagine a Mumbai Indians-type franchise in The Hundred, selling out crowds, and half a million viewers in India tuning in at prime time every day. With this new plan [The Hundred expansion], that’s the kind of play you can expect,” says an India-based sports marketing professional with prior experience in cricket leagues.

While all of this sounds good, there is still the question of whether Indian players will participate. A county representative The Playbook spoke to felt that having Indian cricketers in the tournament will sell out most matches.

“There’s a gradual realisation that they need Indian owners [and by extension, the BCCI] to take an interest,” says the cricket writer quoted above. “Getting Indian players to play in the competition would be a coup.”

That, however, appears to be unlikely, given the BCCI’s strict diktat on players plying their trade in overseas leagues.

Indian Premier League franchise owners are lining up for their piece of the holy grail in franchise cricket: England's The Hundred competition.