India’s Aircraft Repairs Industry Needs To Catch Up

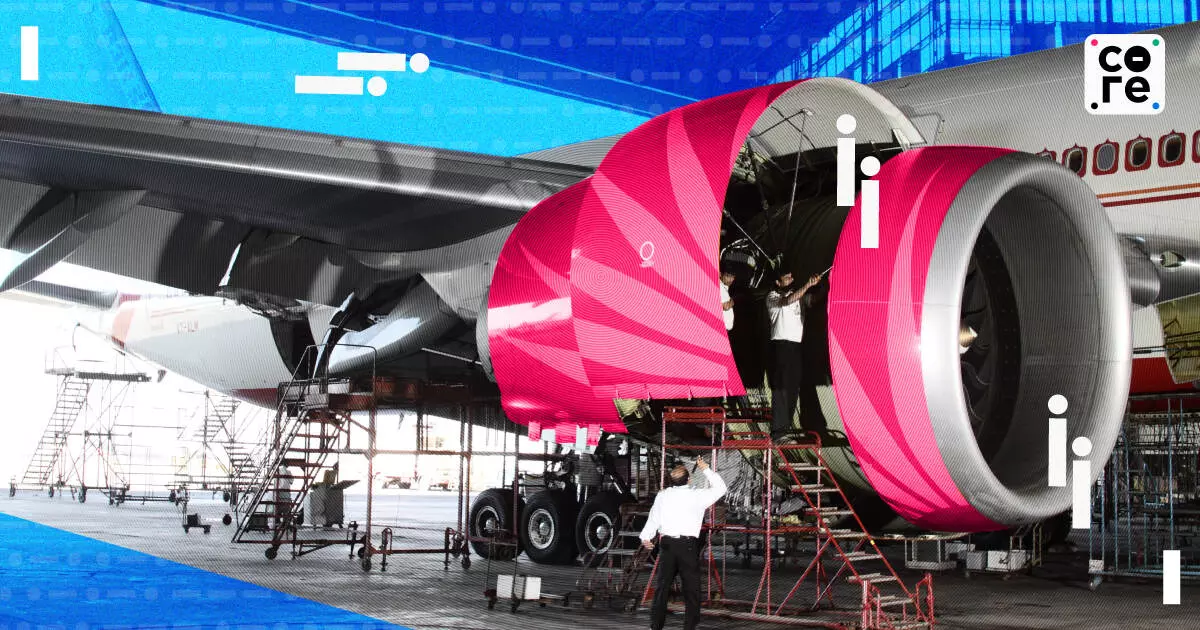

The Indian MRO sector encounters various challenges, including difficulties in securing investments, inadequate infrastructure and high taxes, among others.

During the Union Budget this year finance minister Nirmala Sitharaman eased regulations for the aviation maintenance, repair and overhaul (MRO) industry, aiming to turn India into a key hub for these facilities and promote the transportation sector. Sitharaman extended the timeframe for export of goods that have been imported for repairs from six months to a year.

India’s civil aviation market is booming, with soaring demand for aircraft and aero engines. However, the MRO sector in the country is waiting to be fully tapped into.

“The real issue is the lack of competitiveness among our MROs. The government still seems to underestimate the potential for MRO services export, focusing more on domestic markets. This approach needs to change to unlock the full opportunities in MRO services,” Mark Martin, founder and CEO of aviation consultancy Martin Consulting, told The Core.

As Asia becomes the new growth epicentre for commercial aviation, the Indian MRO market is poised for significant expansion. Indian airports are forecasted to handle 1,124 million passengers by FY 2040, a substantial increase from 187 million in FY 2018, reflecting an impressive annual growth rate of 8%.

The number of aircraft in service, 750 at the moment, is projected to more than double within five years, making India’s fleet the third-largest globally by 2026, surpassing the United Kingdom.

Air India has an order for 470 new aircr...

During the Union Budget this year finance minister Nirmala Sitharaman eased regulations for the aviation maintenance, repair and overhaul (MRO) industry, aiming to turn India into a key hub for these facilities and promote the transportation sector. Sitharaman extended the timeframe for export of goods that have been imported for repairs from six months to a year.

India’s civil aviation market is booming, with soaring demand for aircraft and aero engines. However, the MRO sector in the country is waiting to be fully tapped into.

“The real issue is the lack of competitiveness among our MROs. The government still seems to underestimate the potential for MRO services export, focusing more on domestic markets. This approach needs to change to unlock the full opportunities in MRO services,” Mark Martin, founder and CEO of aviation consultancy Martin Consulting, told The Core.

As Asia becomes the new growth epicentre for commercial aviation, the Indian MRO market is poised for significant expansion. Indian airports are forecasted to handle 1,124 million passengers by FY 2040, a substantial increase from 187 million in FY 2018, reflecting an impressive annual growth rate of 8%.

The number of aircraft in service, 750 at the moment, is projected to more than double within five years, making India’s fleet the third-largest globally by 2026, surpassing the United Kingdom.

Air India has an order for 470 new aircraft, IndiGo’s order for 500 A320s, and Akasa Air’s acquisition of 150 B737-8s show that these carriers have ambitious plans.

Despite these optimistic projections, the MRO sector encounters various challenges, including difficulties in securing investments, inadequate infrastructure, high taxes, licensing issues, and steep rental costs.

Currently valued at $1.7 billion, India’s MRO market for commercial aircraft is expected to grow by 9% annually, reaching $4 billion by 2031. However, with 80-85% of this market serviced overseas, India misses out on considerable value-added opportunities. Notably, engine MRO, which comprises 50% of the market, is nearly entirely outsourced.

Why Are Aircraft Sent Abroad for Maintenance?

India has about eight major players in the MRO market (airframes and engines), including Air India Engineering Services (AIESL), Air Works India, Max Aerospace and Aviation, GMR Aero Technic and Hindustan Aeronautics Limited leading the charge.

All these facilities are Directorate General of Civil Aviation (DGCA)-certified, with most also holding European Union Aviation Safety Agency (EASA) and Federal Aviation Administration (FAA) certifications.

Despite this, aircraft fleets in India are predominantly on lease, leading lessors to sending aircraft to MROs in Singapore, Malaysia, Indonesia and European countries.

“Uber, for example, is the world’s largest taxi operator but doesn’t own any taxis. Similarly, IndiGo is the world’s largest airline by market capitalisation and doesn’t own a single aircraft. So why should someone who doesn’t own an aircraft end up owning an MRO?” Martin said.

In contrast, many European airlines, such as Lufthansa, Air France, and KLM, own their aircraft and operate their MRO facilities to achieve significant cost efficiencies in maintenance.

“India is becoming a top destination for airlines MRO. Companies like Air Works India and GMR are thriving and attracting business from other countries, earning foreign exchange for India. If foreign airlines recognise our MROs, why shouldn’t Indian carriers do the same?” Pulak Sen, founder secretary general of the MRO Association of India told The Core.

The reluctance to invest in MRO facilities in India is partly due to the high costs involved. According to the Indian MRO Market report, the substantial capital required to meet future demands has discouraged current players in the market from making significant investments.

Hefty service taxes also prevent investments in MRO facilities in India. “India has one of the highest taxes on MRO services with 18% GST. So, if an MRO bill is between US $300,000 to US $800,000, the 18% GST makes it cheaper to send the aircraft outside India,” said Martin.

With limited investments, engine MRO, which alone requires an investment of US $100 - US $300 million can be extremely difficult to execute for Indian players with limited investments.

“Another reason why aircraft from India are sent to Europe is because the quality of work is significantly better and turnaround times are faster. The high standards and stringent regulatory requirements in Europe ensure that aircraft are released only when they are perfect,” Martin added.

Taxation And Policy Shifts

The Indian government is implementing several policy changes to transform the country into a global MRO hub. Key measures include reducing the Goods and Services Tax (GST) on MRO services from 18% to 5%, introducing long-term land lease policies to lower rental costs, and eliminating the 13% royalty charged on revenue by the government. These changes aim to reduce the overall costs by 10-20%.

The tax rationalisation process for components has undergone two phases. In 2022, the output tax on MRO services was reduced to 5%, making these services more attractive for airlines in India.

However, input taxes remained high, leading to an inverted duty structure where the output tax was lower than the input tax. This created tax accumulation and necessitated refunds from the government. Recently, the government has reduced the input tax to 5%, aligning it with the output tax.

In July, India's new Civil Aviation Minister, Kinijrapu Rammohan Naidu, announced a flat 5% tax on all aircraft components and engine parts imports, effective immediately.

This new rate replaces the previous range of 5% to 28%, covering everything from parts and components to testing gear and toolkits for aircraft maintenance.

Gone are the days of the old, confusing tax rates that ranged from 5% to 28%. This move, greenlit by India's GST Council in June, means that everything from parts and components to testing gear, tools, and toolkits for aircraft maintenance will now be taxed at this unified rate.

“The cost of doing business in this region needs to be competitive from MRO facilities in the Philippines to Turkey to Singapore. I am pleased that our tax structure is now par with Singapore's (7%), one of the largest MRO markets. From a taxation standpoint, we are now playing in a competitive field,” Anand Bhaskar, managing director and CEO, of Air Works India told The Core.

However, significant policy changes such as the GST reduction and extended land lease periods have only recently been implemented, and their effects will take time to materialise. Meanwhile, countries like Singapore and Malaysia are luring MRO investments with tax credits on reinvestments.

“India has allowed 100% FDI for MROs, but investments have been lacking due to the tax structure. With the new lower tax rates, we expect investors to show interest, leading to a thriving MRO sector. We are one of the largest markets globally, close to China, with 2,000 aircraft expected in the next five to seven years. This will create significant demand for MRO services and skilled professionals,” Sen added.

Future Outlook

The budget announcement also confirmed the continuation of policy measures aimed at making India an attractive destination for leasing and finance.

“The budget is a positive step for aircraft and engine repairs in India. Previously, repairs and the export-import process had to be completed within six months. Now, there is flexibility to extend this period to a year. This change allows more time for repairs and handling, providing greater ease for both aircraft and engine maintenance. Additionally, warranties have been extended from three to five years, offering better coverage for potential issues,” Rajeev Dandona, deputy general manager at AIESL told The Core.

While India is self-sufficient in heavy maintenance and attracts international aircraft for this purpose, it still lags in component and engine overhauls. The government's extension of the period aims to facilitate these processes, including components.

“For example, components like landing gear and engines usually come with a three to five-year warranty. If warranty service is needed, these components return to India for support before being re-exported. To support this, the government has increased the period from three to five years. Our focus is to ensure seamless component and engine overhauls within the country,” Bhaskar said.

Need For Comprehensive Regulations

MRO remains a nascent industry in India. For instance, Singapore’s Seletar Airport has a decade-long policy attracting Original Equipment Manufacturer (OEM) investments, while Indonesia has a clear MRO policy.

“Unfortunately, India lacks a dedicated MRO policy. It is barely mentioned in the national aviation policy, and there's no coordinated effort to ensure airports support MROs or that airlines service their aircraft domestically. No such rules exist here in India,” Sen said.

MRO facilities provide services like engine overhauls, avionics repairs, structural repairs and interior refurbishment.

Among Indian MRO players, only AIESL offers all four types of MRO services. However, their facilities have historically been severely underutilised and only recently received international accreditation.

Other Indian companies are limited to offering just 2-3 types of MRO services. In contrast, most major global players provide the full spectrum of MRO services.

Europe has unified regulations to keep its aviation business within Europe. The US, for example, has FAA and bilateral agreements with Canada and Brazil.

“But Asia is fragmented. Regulations differ between India and neighbouring countries like Sri Lanka, Pakistan and Bangladesh. You need separate approvals and certifications for each, and major players like China, Thailand and Singapore don't accept each other's standards. This mess prevents a unified market, forcing us to send our aircraft to other countries,” Dandona added.

The Road Ahead

The Indian aviation industry is set for dynamic growth, with airlines gearing up to meet rising demand. But it is likely that MRO facilities in India won’t match the growth of the aircraft fleet.

“As our fleet grows rapidly, our regulations aren’t keeping up. MROs need to develop, whether through organic growth or joint ventures. Currently, a handful of MROs in India handle aircraft maintenance, while smaller MROs, which have component shops for avionics and other parts but we need investment to expand,” Sen concluded.

Dandona is of the opinion that Indigo and Air India have ordered thousands of aircraft without considering technology transfer.

“They should have insisted the OEMs to build the aircraft in India to gain valuable technology and expertise. Instead, they focused solely on getting the aircraft at a lower price. This short-sighted approach means that, down the line, these OEMs will recoup their discounts by charging higher maintenance costs,” said Dandona.

At Aero MRO India A&D 2023, hosted by the MRO Association of India, SP’s Aviation reported that the significant aircraft orders placed by Indian airlines are set to build a substantial fleet.

This expansion will empower domestic carriers to secure more favourable leasing terms with lessors and utilise local non-critical parts, potentially reducing costs by over 40%. Industry executives also noted that the turnaround time for some parts is expected to decrease dramatically, from six months to less than 30 days.

“Aircraft heavy maintenance is indeed happening domestically. As more aircraft are added to the fleet, I am confident that the industry will ramp up its capacity to keep pace with the growing demand,” Bhaskar added.

The Indian MRO sector encounters various challenges, including difficulties in securing investments, inadequate infrastructure and high taxes, among others.