Why Venture Capitalists Back Indian Edtech Despite Failures

Despite past missteps and ethical concerns, venture capitalists are doubling down on India's edtech, but with a renewed focus on upskilling and B2B SaaS.

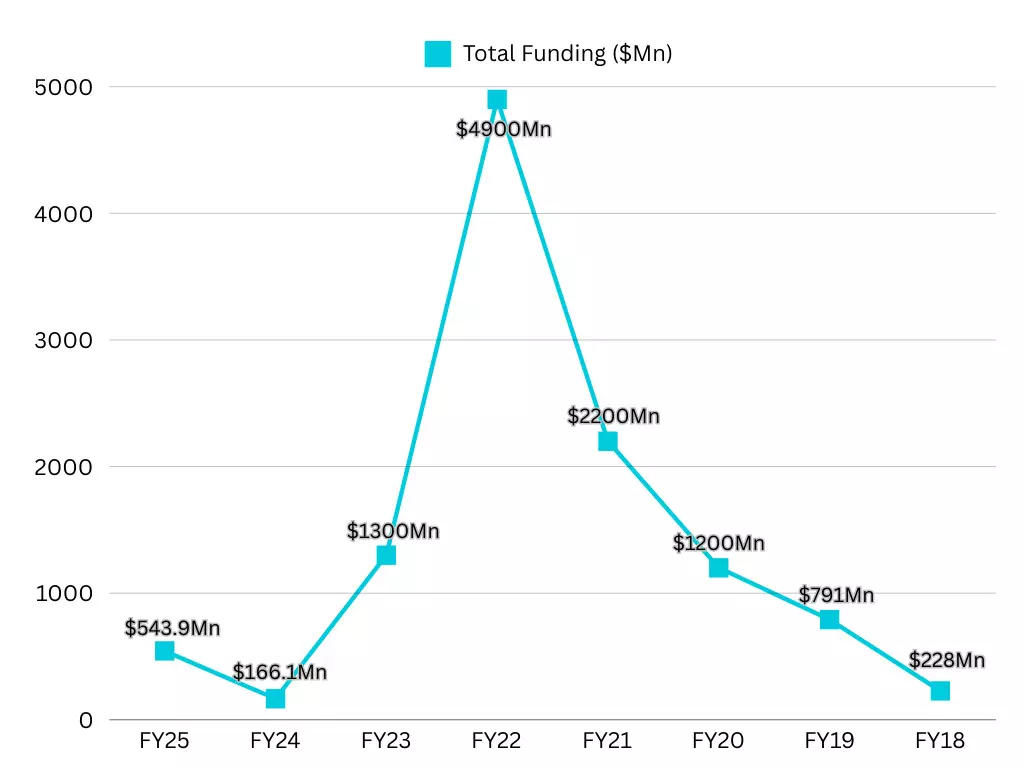

Edtech funding in India has been on a rollercoaster ride in recent years. If we were to consider the funding data from 2017 to 2024, it is evident that there have been clear spikes and declines over the years. But given the Byju's debacle—once valued at $22 billion and now the most beleaguered startup in the country—the edtech segment has come a long way.

The edtech segment in India—largely comprising K-12 coaching and test-prep coaching—has always been a stellar money puller, with large venture capital firms and private equity players pouring in multiple billions of dollars. Since 2017, it has continued to be a money puller in India's consumer Internet ecosystem. But that changed in 2022 after several edtech companies, including Byju's, Unacademy, and Vedantu, began laying off employees amongst many other large tech companies. These three companies, which were once hailed as "successful edtech unicorns," began showing signs of trouble, including allegations of unethical consumer practices, fraud, mounting debt, and even shutdowns of subsidiaries.

But before trouble started brewing in India's edtech wonderland, venture capitalists, especially those with a taste for growth-stage companies, jumped in headfirst. Let's peek at the funding figures to get the full picture: data from private investment tracker Tracxn showed that in FY18, edtech startups raked in $227.9 million across 177 deals. In FY19, this number ballooned to $7...

Edtech funding in India has been on a rollercoaster ride in recent years. If we were to consider the funding data from 2017 to 2024, it is evident that there have been clear spikes and declines over the years. But given the Byju's debacle—once valued at $22 billion and now the most beleaguered startup in the country—the edtech segment has come a long way.

The edtech segment in India—largely comprising K-12 coaching and test-prep coaching—has always been a stellar money puller, with large venture capital firms and private equity players pouring in multiple billions of dollars. Since 2017, it has continued to be a money puller in India's consumer Internet ecosystem. But that changed in 2022 after several edtech companies, including Byju's, Unacademy, and Vedantu, began laying off employees amongst many other large tech companies. These three companies, which were once hailed as "successful edtech unicorns," began showing signs of trouble, including allegations of unethical consumer practices, fraud, mounting debt, and even shutdowns of subsidiaries.

But before trouble started brewing in India's edtech wonderland, venture capitalists, especially those with a taste for growth-stage companies, jumped in headfirst. Let's peek at the funding figures to get the full picture: data from private investment tracker Tracxn showed that in FY18, edtech startups raked in $227.9 million across 177 deals. In FY19, this number ballooned to $791.4 million. And in the following years–FY20, FY21, FY22, and FY23–these startups consistently bagged at least a billion dollars each financial year.

Edtech funding reached its peak in FY22, hitting a massive $4.9 billion across 365 deals. Byju's, Upgrad, Vedantu, Unacademy, Eruditus, LEAD School, and Physicswallah were among the big winners in this funding frenzy. The star of the show? Byju's, of course, which scooped up a lion's share of the funding with $3.5 billion (including both equity funding and debt).

In India's startup ecosystem, edtech firms were suddenly the hottest ticket in town, attracting significant attention from investors. Venture capitalists and private equity firms had good reason to place such large bets on the country's edtech sector. With schools and colleges closed, online learning became a necessity, and investors were convinced that this trend would continue.

Furthermore, India's mobile internet penetration has surged in recent years, driven by affordable data plans and the COVID-19 lockdown. In 2022, India boasted over 700 million mobile internet users, with the average rate for 1GB of data being the lowest globally. This accessibility, coupled with the pandemic-induced shift to online learning, created a massive Total Addressable Market (TAM) that was simply too enticing for investors to ignore. The potential for growth in India's edtech sector was undeniable, and venture capitalists were eager to capitalize on this burgeoning market.

The Edtech Bubble Bursts

But within just a year or so, the edtech world began crumbling, and it's safe to assume that most investors who took these large bets were very wrong. By FY23, India's startup investors—especially global venture capitalists and private equity firms—began reassessing their positions under pressure from their limited partners who invest in these funds. The funding winter of 2023, coupled with global and domestic economic headwinds, caused a sharp decline in overall startup funding. Venture capital investments declined sharply in India, dropping to $11 billion in 2023—a mere 26% of the $42 billion invested in 2021. Indian venture funding in startups plummeted to pre-2017 levels, with both the total value of deals and the number of deals dropping by over 60%. This dramatic decline forced investors to re-evaluate their strategies and prioritize profitability over rapid growth.

And let's not forget the ethical and financial earthquake that shook India's edtech scene in 2022-2023. The pressure to sell, fueled by those hefty funding rounds, led to some questionable practices. Edtech giants like Byju's (focused on K-12 and test prep) and Upgrad (targeting freshers and working professionals with upskilling courses) were accused of pushing hefty loans onto students and professionals who later struggled to repay them.

Byju's faced accusations of overselling loans and even misrepresenting its courses bundled with EMI loan products. Upgrad, on the other hand, was selling overseas migration dreams to students enrolling in international dual-degree courses by attaching loan products. Many working professionals who took these loans were then hit by layoffs or couldn't secure visas—something Upgrad should have anticipated but didn't due to sales pressure.

And probably one of the biggest financial downfalls is the saga of Byju's. It all started with a $1.2 billion term loan that the company faltered on repaying from the first instalment. Byju's term loan investors in the US are currently battling the company in the US and Indian courts, accusing it of malpractice and even concealing crucial information about the utilization and transfer of these loan funds. The future of Byju's remains uncertain as the legal battle continues and the company grapples with mounting financial challenges.

Amidst this turmoil, it's the workforce, the employees, and the learners who ultimately bear the brunt. An Inc42 report revealed that in 2022, the edtech downturn and funding crunch impacted 15,000 jobs in India's edtech industry. Hundreds of edtech startups, mostly in the early stages, shut down, with some managing to return cash to investors. Yet, the edtech downfall hasn't completely deterred investors, as funding slowly trickles back into the sector.

Funding data shows that in FY25, edtech firms have raised an impressive $544 million across 40 rounds, a significant increase compared to the $166 million raised across 102 rounds in FY24. However, there's a clear shift in funding strategy and target. Firstly, large foreign investors like Softbank (stung by Byju's experience), Tiger Global, Prosus Ventures, and others have distanced themselves from India's K-12 and test-prep segments. The most active investors in FY25 are primarily India-based angel networks and seed funds like LetsVenture, Peak XV Ventures, Blume Ventures, and a few foreign seed funds like Better Capital and Y Combinator.

Secondly, and most importantly, upskilling platforms like Eruditus and Upgrad, and B2B-focused SaaS players like Toddle and Educational Initiatives, have attracted significant investment. PhysicsWallah recently raised $210 million, followed by Eruditus ($150 million) and Upgrad ($60 million).

The trend is clear: Venture capitalists haven't given up on edtech in India. They're simply placing larger bets on B2B SaaS offerings for schools and colleges and the burgeoning upskilling and online degree segment.

A New Dawn for Edtech?

Investors and analysts tracking the edtech segment told The Core that venture capitalists are now treading carefully despite increased investment. Kushal Bhagia, founder of early-stage fund All In Capital, explained that the appeal of online degree platforms like Upgrad and Eruditus stems from a genuine need for upskilling among corporate employees. Working professionals, unlike K-12 students, have the financial means and motivation to invest in their education, making them an attractive market for investors. However, Bhagia emphasized that the fundamentals of edtech investment have changed significantly.

"Our fund now prioritizes product quality and learning outcomes over aggressive marketing and sales tactics," Bhagia explained. "We focus on companies that demonstrate a clear ROI for learners, whether through exam preparation or job-oriented upskilling programs. High student engagement, measured by metrics like average learning time, assignment completion rates, and participation in live lectures, is also critical."

This shift is reflected in the valuations of large edtech companies seeking funding. Data from Tracxn shows that the average valuation for late-stage rounds in FY25 stands at $309 million, a significant drop from the $4.4 billion average in FY21.

However, many of these funding deals focus on online degree and upskilling platforms like Eruditus and Upgrad, driven by their impressive revenue growth. The Economic Times reported that Eruditus has emerged as the largest Indian edtech firm by revenue, generating Rs 3,800 crore in FY24. Ashwin Damera, CEO and Co-Founder of Emeritus and Eruditus, told The Core that the company is on track to reach Rs 5,000 crore in revenue for FY25.

Upgrad also boasts strong financial performance. According to The Arc, Upgrad reported gross revenues of Rs 1,715 crore ($204 million) in FY24, a 25% increase from FY23. Mayank Kumar, Co-founder and Managing Director of Upgrad, told The Core that the company is on track to achieve a revenue of Rs 2,500 crore in FY25.

While Upgrad and Eruditus boast impressive revenue figures, profitability remains a challenge. In FY23, Eruditus reported a net loss of Rs 1,049 crore, an improvement from the Rs 3,094 crore loss in FY22. Damera of Eruditus, however, claims that the firm is on track to achieve an EBITDA profit of Rs 300 crore in FY25.

Upgrad's net loss surged by 76% year-on-year, reaching Rs 1,141.5 crore in FY23, compared to Rs 648.2 crore in FY22. Kumar of Upgrad claims that the company achieved EBITDA profitability in the September quarter and projects a 10% net positive EBITDA margin for FY25.

Despite these positive projections, securing funding, especially for early-stage edtech companies, remains a challenge. Damera highlights that while there's investor interest in edtech, it's primarily focused on late-stage companies with proven models. “While there's been some investor interest in edtech, it's mostly focused on late-stage companies with proven models. India needs more than just a few successful edtech companies; we need an entire ecosystem fueled by early-stage investment,” he added.

Another hurdle is the acceptance of online degrees among HR leaders in startups and MNCs. While not all major IT and tech firms readily accept online degrees, the tide is gradually turning. Shantanu Rooj, Founder and CEO of TeamLease Edtech, notes that the acceptance of online learning has significantly improved due to the enhanced quality of online programs.

“This improvement is driven by advancements in technology and a better understanding of online pedagogy, particularly the importance of manageable cohort sizes. We've seen a shift from massive online classes of 100 or more students to smaller, more focused groups, sometimes even approaching 1-on-1 instruction. This allows for greater interaction, personalized feedback, and deeper learning, which resonates with HR leaders. While not a replacement for traditional classrooms, online learning offers a viable alternative, especially for those who cannot attend physical classes,” added Rooj.

Navigating the Challenges Ahead

Despite the progress, challenges remain for edtech companies offering online degrees and upskilling programs. In India, the legal framework is clear: edtech companies cannot grant degrees themselves. This authority rests solely with recognized universities and institutions. Edtechs can partner with these institutions to provide technology and support, but the academic delivery and degree-granting remain the institution's prerogative.

Concerns persist regarding online degrees offered by foreign universities, which currently operate in an unregulated space in India. “Students should exercise caution when considering such programs as their recognition and validity within India may be questionable. And, it's crucial for edtech companies to maintain ethical practices and avoid misleading students by promising guaranteed placements or jobs upon completion of their online programs,” added Rooj.

Currently, online degree and upskilling programs primarily target working professionals in the early stages of their careers and freshers. These courses see less demand from professionals with over 10 years of experience. This limited market means that companies like Eruditus and Upgrad must continue investing in marketing, which drives up customer acquisition costs.

Furthermore, online degrees do not gain widespread acceptance at higher experience levels, such as those in VP and SVP positions. For executive roles, practical experience and foundational education are paramount. Recruiters prioritize a candidate's achievements and track record over online certifications or degrees.

Bharati Mujumdar, Operations Head at Venator Search Partners, notes that while professionals may showcase online certifications on their LinkedIn profiles, these rarely feature on resumes, especially for senior roles. She expresses concern about individuals claiming to possess degrees from prestigious institutions like IIMs based solely on short-term online courses, highlighting the distinction between a full-fledged MBA and an executive education program.

“While mid-level managers benefit from upskilling to stay current, senior executives with 20-plus years of experience often learn on the job and focus on strategy. They may attend executive programs at IIMs or abroad, but more for networking or personal growth than career advancement. Experienced professionals still value traditional learning formats with offline modes, but in my view, practical experience outweighs online degrees at that stage,” added Mujumdar.

Nevertheless, the curious case of India's edtech resurgence is ongoing, as evidenced by the presented data. It's a tale of dramatic highs and lows, of billion-dollar bets and ethical tightropes, of shifting investor appetites and the enduring quest for knowledge (and profit!). While the K-12 and test-prep segments may have lost their shine, the upskilling and B2B SaaS spaces are attracting renewed attention. But with profitability still a question mark and the acceptance of online degrees facing hurdles, the road ahead remains a winding one. Will India's edtech sector finally find its footing and deliver on its promise? Only time will tell.

Despite past missteps and ethical concerns, venture capitalists are doubling down on India's edtech, but with a renewed focus on upskilling and B2B SaaS.